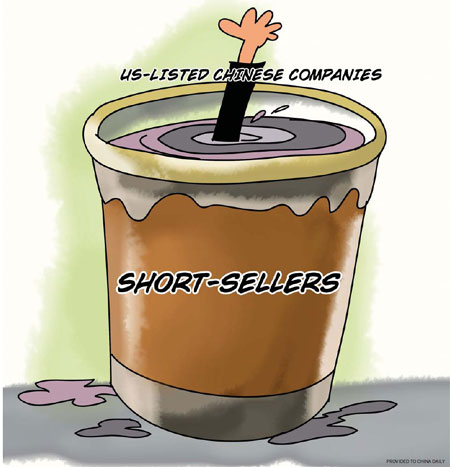

US short-sellers muddy the waters

|

A trader on the floor of the New York Stock Exchange. The differences in accounting rules between China and the US is the main reason for widespread short-selling of Chinese companies listed in the US, experts said. Jonathan Alpeyrie / Polaris |

Convergence of accounting rules could help firms lose 'fraud' label

BEIJING - Although shares of US-listed Chinese companies have started to rally recently, the end of 2011 saw them under pressure as the result of a series of short sales.

In the last three months of 2011 around 58 Chinese companies were facing the prospect of delisting from the US market, either because their share prices had fallen below the $1 mark for 30 consecutive days or their market capitalization was less than $35 million, according to reports in the Economic Information Daily newspaper.

"If a company's stock price or market cap does not meet the requirements of the US market, it will be sent to the Pink Sheets (the third tier of the over-the-counter market, where companies do not have to report to the US Securities & Exchange Commission or other regulators), where they will be lumped together with a lot of bad companies. Investors cannot tell the good from the bad and so they will not buy any of them," said Hong Hao, an equity strategist at China International Capital Corp Inc.

One of the most high-profile cases of US short-selling of a Chinese company is that of Sino-Forest Corp. Last year, the Hong Kong and Canada-based company was accused of financial irregularities by the US researcher, Muddy Waters LLC. The ongoing furore - which was inflamed after Carson Block, the founder of Muddy Waters, accused the Chinese company of being a 'Ponzi' scheme - saw Sino-Forest's share price plummet and brought the whole issue of short-selling of Chinese stocks to prominence.

"The difference in accounting rules between the two nations (China and the US) is a fundamental reason for the problem," said Chen Yugui, vice-president and secretary-general of the Chinese Institute of Certified Public Accountants.

Chen said that, according to US regulations, if an accounting firm wants to undertake assurance work for a company listed in the US, it should register with the US Public Company Accounting Oversight Board (PCAOB). Although a few Chinese outfits have registered with the PCAOB and are approved by the authority, many more are qualified, but have not been engaged for a variety of reasons.

"So when Chinese companies purchase 'shell' companies, in a process also known as a 'reverse takeover', to obtain a listing, their assurance work is usually conducted by small agencies, including some low-level firms that simply help with the listing procedure and then exit without offering further financial guidance.

Therefore, many Chinese companies list on the US market without being fully aware of their responsibilities or knowing how to compile annual reports under the US rules," said Chen.

He added that a few Chinese companies do have financial problems that should be checked and rectified, but many of them are not governed by the regulations pertaining to either nation.

"US-listed Chinese enterprises need not be examined by Chinese authorities, but the US does not check their financial statements in China because all their accounting work is signed off by US accountants," said Chen.

Zhou Hongyi, chairman and chief executive officer of Qihoo 360 Technology Co Ltd, China's leading Internet company in terms of active user base, wrote on his blog that a limited understanding of Chinese innovative business models is another reason why a short-seller can hurt a Chinese company.

"We (Qihoo 360) created the idea that our software is completely free and our business model based on it is unique. Because our company's business model does not have a parallel in the US and the performance of our stock is very good, this may be the kindest explanation for Citron's short-selling against us," said Zhou.

Since November 1, CitronResearch.com has released four unflattering reports on Qihoo 360. The company responded positively by releasing reports of its own and on December 7, when Qihoo 360 published its third response to the reports, its stock closed higher by 3.35 percent.

Hong said that although a few Chinese concept stock companies - defined by Investopedia.com as "a company whose assets or earnings have significant activities in China" - have financial problems, many of them are of high quality and are welcomed by US investors.

"When the US economy is not good, companies' financial problems are more easily exposed. Other companies should regard it as a warning and take care of their own financial conditions. However, we can see that China concept stocks, such as New Oriental Education & Technology Group Inc, Home Inns & Hotels Management Inc and Mindray Medical International Ltd, are very popular among investors.

"It's not a good time for Chinese companies to list on the US market; instead, they can consider delisting because share prices are very low," said Hong.

According to Hong, current conditions in the Chinese stock market are not favorable, so US-listed Chinese companies can take their time delisting from the US market. He added that it usually takes a company one full year to deal with the delisting process.

"No matter whether they are delisting from the US market or continuing to play, Chinese companies should always be strict with their financial statements and improve their competitiveness and financing capability," Hong said.

Yang Ge, the chief representative at the Beijing bureau of NYSE Euronext Group, said that the strong development of the Chinese economy means that US investors have been showing great confidence in Chinese companies and that they welcome Chinese enterprises with good prospects listing in the US market.

"Compared with several months ago, investors are no longer easily influenced by reports released by short sellers. Instead, they have been able to tell the good companies from the bad," Yang said.

"Our best ways of combating short-sellers are good governance, transparency and strong investor relations. We are inviting good investor-relation companies, including Thomson Reuters Corp, to help companies improve their communication with investors," he added.

Zhou Hongyi said after the short selling, Qihoo 360 will deepen communication with overseas investors. In addition, he said the company will continue to focus on offering users high-end experiences and creating long-term value for them to develop Qihoo 360 into an influential company.

According to Chen, Chinese accountants are necessary for Chinese companies looking to list in US. Meanwhile, US accounting firms also hire Chinese partners to deal with assurance work, because they have a limited understanding of China and feel that the work is too difficult to be undertaken without back-up.

"If Chinese accountants can sign their names on the auditing report, which means they can be responsible for the auditing work of Chinese enterprises listed in the US, the auditing processes and standards can be simplified and the regulations will be more strict."

Chen said that to achieve that goal, China and US should work together to promote the convergence of the accounting systems, so that eventually Chinese accountants will be accepted in US market and vice versa.

Chen said China and the European Union have reached an agreement on the convergence of accounting systems, which will mean that Chinese accountants can be directly responsible for Chinese companies going public in the European market.

According to Yang, although only a small number of Chinese companies listed in the US during the last four months of 2011, conditions will improve in 2012. Yang said that NYSE Euronext has about 20 companies in an active pipeline. He believed that there will be a handful of deals that will test the market in the first few months of 2012 and then a larger group will emerge in the first half of the year.

"Companies in sectors such as Internet, electronic commerce and new energy are easily accepted by US investors. And we are encouraging companies with high growth potential to come to the US market because they will have good valuations here," said Yang.

"The US market is not good now and we will follow Vancl and Xunlei and list in the US," said Li Shubin, president of the Chinese online shoe retailer OkBuy.com,

Vancl.com, China's biggest online clothing retailer, and Shenzhen Xunlei Network Technology Ltd, a video and music file-sharing company, had both planned to go public in 2011, but delayed their IPO plans until later this year.

Li said the current economic uncertainty in the US, coupled with the behavior of short-sellers with regard to Chinese companies, prevented a number of Chinese companies, including OkBuy.com, from going public in the US in the last few months of 2011.

However, Li said he is not too concerned about the short-sellers because electronic commerce companies face their end users directly and their performance indexes, including the purchasing rate, are publically available.

"Amazon is a good instance of e-commerce companies being widely recognized in the US, so we would like to choose the US market," Li said.

Hu Boyu, an associate at DCM, a global venture-capital company, said the companies his company has invested in are mainly engaged in popular sectors in the US, including technology, media, and telecoms, and have their investment funds in dollars, so the US market will still be their main choice for a public listing.

Hu added that many companies with foreign investment funds are not able to list in the domestic market, and that those companies leaving the US market and listing in China can not be guaranteed a successful listing.

China Daily

(China Daily 02/13/2012 page13)