Official calls for reforms to help ease tax burden

The government should adopt more effective budget controls and further reduce taxes to ease the country's tax burden and bring more stability to its surging fiscal revenues, experts and entrepreneurs say.

"Although the tax burden in China is not high compared with what it is in developed countries, that doesn't mean we are without problems," Jia Kang, a member of the Chinese People's Political Consultative Conference National Committee and director of the Ministry of Finance's fiscal science research center, said on Saturday.

The country has often brought in more taxes than expected because its collection goal has been set a bit higher than what is needed to cover its planned expenditures, Jia said.

Jia's words came ahead of the release of a budget report on Monday. The document showed that the revenue the country collected in 2011 came in at 544.6 billion yuan ($86.3 billion) in excess of what was called for by a goal set at the beginning of last year.

The data also came out at about the same time that China Entrepreneur magazine reported that more than 60 percent of 100 companies it polled at the beginning of 2012 complained that they were shouldering heavy tax burdens.

Among manufacturers, which tend to have relatively low profit margins, one in five companies said their profits have been eaten up by tax payments, according to the survey.

Even in service industries, which tend to have higher profits, 57 percent of the companies polled said tax payments have taken up more than half of their profits.

Last year, the government raised the minimum income to which the income tax will be applied, reformed the value-added tax - which is charged on goods sold in China - and adopted other reforms. Even so, nine out of 10 of the companies surveyed said the measures did not go far enough and said they were expecting to see further reforms.

When delivering the Government Work Report on Monday, Premier Wen Jiabao reiterated that the country's 2012 economic plans place an emphasis on reform.

"We will continue testing out changes to the value-added tax, eliminating administrative surchargesimproving consumption taxes and deepening the reform of the resources tax," Wen said.

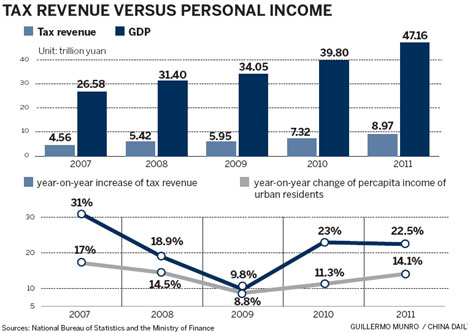

Jia said the amount of tax revenue China collects has been increasing more quickly in recent years, becoming equivalent to more than 20 percent of the country's GDP. The increase has been the result of the low tax rates that were imposed when China's economy began to open up.

"The current goal would be to make the growth stable and avoid a further rapid increase," Jia said.

He also said authorities could supplement the country's budget by making more use of the bond market and thus reducing the government's dependence on taxes.

Jia's words were echoed by another CPPCC member, Li Jiange, chairman of the financial services company China International Capital Corp Ltd, who called for the adoption of amendments that would strictly limit the government's authority to collect taxes.

Li suggested that an annual "prescribed target for fiscal revenue growth" be set for local governments, and that anything exceeding the target be looked at as a "deviation from the budget" rather than "good work by tax authorities".

"If we could bring down the growth rate for fiscal revenue to within 10 percent this year, we would save businesses and residents at least 1 trillion yuan," Li said.

weitian@chinadaily.com.cn

(China Daily 03/07/2012 page15)