Caterpillar eyes huge growth in China

|

Caterpillar's engineering machinery products on display at an exhibition in Beijing. The company plans to double the number of its employees in China by 2015. Wu Changqing / for China Daily |

Caterpillar Inc, the world's largest construction machinery manufacturer, plans to double its 11,000-strong workforce in China by 2015, in a sign of its continued confidence in the sector.

Besides, Caterpillar's dealers in China are expected to significantly add to their workforce in the next four to five years due to China's growing economic clout, said Richard P. Lavin, Caterpillar's Group president, in an exclusive interview with China Daily.

Kevin Thieneman, chairman of Caterpillar (China) Investment Co Ltd, revealed that the company has nine more factories under construction in China, most of which will be completed this year.

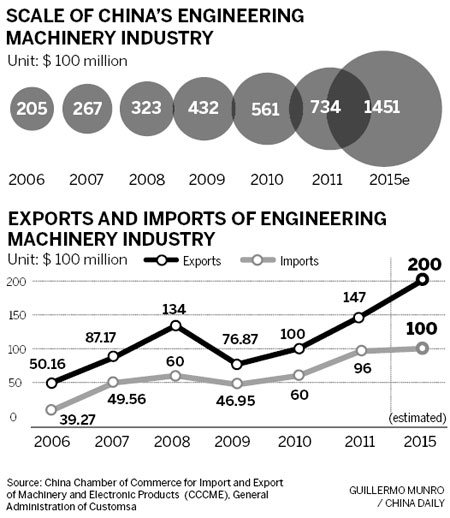

The construction machinery industry has developed by leaps and bounds in China since 2005. However, due to the tightened monetary policy adopted by the central government in the first half of 2011, the industry's development has slowed.

According to the Business & Finance Review, the total cash flow of China's 11 construction machinery companies, whose annual sales surpass 10 billion yuan ($1.5 billion), was minus 2.634 billion yuan by mid-2011, while the figure was 5.613 billion yuan in the same period of 2010.

Concerns about a further deceleration or even a downturn in 2012 have spread throughout the industry.

"However, I still expect 5 to 10 percent growth for China's construction machinery industry in 2012," said Lavin.

Lavin's confidence comes from China's ongoing 12th Five-Year Plan (2011-15), which offers the industry abundant opportunities.

For example, the central government will invest more than 1 trillion yuan in economy housing over the next five years, and 4 trillion yuan in water conservancy projects in the coming decade.

Meanwhile, China and countries in Southeast Asia, including Indonesia and Malaysia, are pressing ahead with urbanization, which requires the large-scale construction of transportation facilities and housing, according to Jonathan Downer, principal in the construction group at KPMG China.

"China's central government has put controls and restrictions on the liquidity of the real estate market, but it's mainly the commercial real estate market," said Downer. "The housing projects, especially in the west, are still a driving factor of the construction industry's development."

Downer pointed out that China's construction industry is embracing the trend of prefabricated building, which is already widely applied in the United States, Europe and Japan.

Construction of Shanghai's first economy housing project to use prefabricated building techniques commenced on Monday. And the city plans to apply the technique to 20 percent of its housing construction projects by 2015, according to the newspaper Wen Wei Po.

Prefabricated building refers to the technique of assembling pre-manufactured parts to build a house, just like building blocks.

The traditional method of building houses is to transport raw materials such as steel and cement to the building site and produce the parts on site.

"It's efficient. A traditional building may need six months to build, while a prefabricated one requires only one month," said Downer. "With so many housing projects to accomplish, China needs the technique."

But the trend toward prefabricated building requires domestic construction machinery companies to step up the pace of their technological innovation.

In fact, the optimization and upgrading of the industry in China demands technological innovation in other respects.

Lin Chengzhen, principal of construction machinery industry at China Chamber of Commerce for Import and Export of Machinery and Electronic Products, pointed out that domestic companies are only strong in terms of medium-sized equipment, whereas they lack the technology and productivity to be competitive in terms of heavy and small machinery.

Heavy machinery is necessary for water conservancy projects and smaller machinery is used in infrastructure maintenance.

Lin added: "With few restrictions regarding entry, China's construction machinery market is basically open to any companies, State-owned, privately owned and foreign-invested. Seeing the rapid growth of the industry, some domestic privately owned companies have adopted a 'follower' strategy, leading to an overheating in the market for some products."

Excavators are an example of this. Han Xuesong, honorary president of the China Construction Machinery Association, is concerned that after current excavator manufacturing projects complete construction, the annual domestic production capacity for excavators will be 610,000 units, while annual global demand is only expected to be around 300,000 units.

"It seems to be a 'winter' for China's construction machinery industry in 2012 with a slowing pace of growth, but it is necessary for the industry to optimize and upgrade its industrial structure in order to embrace the 'spring'," said Lin, who expects mergers and acquisitions among domestic companies.

Another focus for Chinese domestic construction machinery companies during the 12th Five-Year Plan, in Lin's opinion, will be to further their globalization.

SANY Group is taking the lead with the announcement on Jan 30 of its plan to buy 90 percent of the shares in German company Putzmeister Group, and its plan, revealed on Tuesday, to establish two 50-50 joint ventures with Austrian company Palfinger.

Although SANY is the world's sixth-largest construction machinery manufacturer, it is far behind other leading companies from the US, Europe and Japan in terms of globalization.

According to the magazine Construction Machinery and Equipment, only 6.5 percent of SANY's products were manufactured and sold overseas in 2011, while the figure was 68 percent for Caterpillar and 84 percent for Komatsu.

"The quickest way for Chinese companies to acquire technology and expand overseas distribution channels is by carrying out M&As with overseas companies," said Jeremy Fearnley, head of M&A for Hong Kong and Southern China at KPMG China.

"Besides continued cross-border M&As between large companies, I expect we will see more mid-market outbound M&A by private Chinese companies," Fearnley added.

xujingxi@chinadaily.com.cn

(China Daily 03/31/2012 page10)