FDI drops 3% amid slowdown

Expert: China remains attractive to multinational companies in 2012

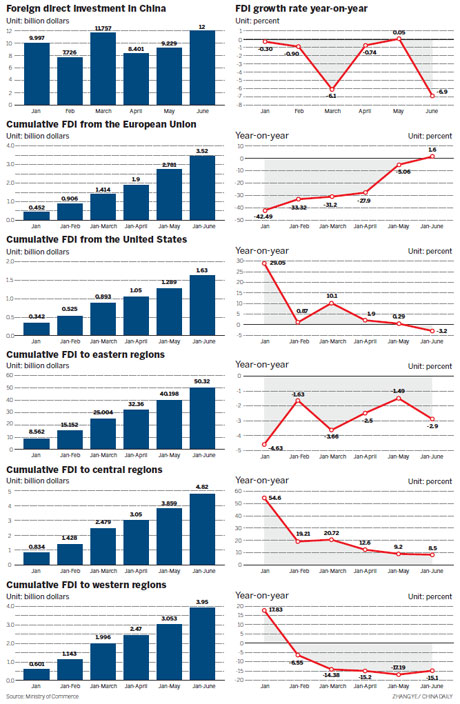

Foreign direct investment in China dropped 3 percent year-on-year to $59.1 billion in the first half of this year amid the country's economic slowdown and the slow recovery of the global economy.

FDI registered $12 billion in June, down 6.9 percent from the previous year, according to the Ministry of Commerce. The decline is the largest drop since December and compares with a 0.05 percent gain in May after a six-month slide.

"Despite the decline in the first half of this year, we hold that the whole year will see a steady expansion of FDI into China," Shen Danyang, spokesman for the ministry, told a news briefing on Tuesday.

"As the Chinese government take steps to stabilize economic growth and boost domestic consumption, the economic expansion will pick up in the second half of this year. This will boost the confidence of foreign investors and increase their investments in China," Shen said.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the ministry, said: "If there were no stimulus measures, FDI flowing into China would not grow significantly this year. The growth would be between 3 percent and 5 percent from the previous year."

He said this year is a very challenging one for China to attract FDI because the European Union is troubled by its debt crisis while the United States is struggling with its own recovery, and the emerging economies saw slower economic growth.

"China needs to take timely measures to enlarge FDI inflow because steady growth of FDI relates to China's stable trade growth and economic expansion, as well as employment."

Huo suggested the eastern region further open up its service sector to attract FDI.

"China can also invite foreign investment into its strategic industries and high-tech industry, and encourage foreign investment in the research and development areas of these industries after a clear definition of the fields open to foreign investment."

Zhang Yansheng, secretary-general of the academic committee of the National Development and Reform Commission, agreed, saying, "China's FDI will not grow fast this year because it has entered a slow expansion era since 2005."

China retained its position as the most attractive economy to multinational corporations in 2012, followed by the US and India, according to an annual survey of world investment prospects by the United Nations Conference on Trade and Development.

"This shows that multinational companies still have great confidence in China's development," Shen added.

Commerce Minister Chen Deming told foreign investors during a meeting on Friday that China will keep supporting the development of foreign enterprises in China while encouraging foreign investment in research and development as well as innovation.

"The huge domestic consumption market, which is expanding fast, provided great opportunities for foreign investors," Shen said.

The government has established a long-term mechanism to crack down on infringement of intellectual property rights, a move to improve the investment environment.

In the next step, the ministry will further open up the service sector and encourage foreign investment in emerging industries, modern agriculture and services, as well as energy conservation and environment protection. These measures will improve the country's use of foreign investments, Shen said.

In addition, the ministry is busy drafting the catalogue for the guidance of foreign investment industries in the central and western regions because foreign investors are enthusiastically investing in these areas after the government's encouragement," Shen added.

Huo said: "There is still room to enlarge the Industry Guidance Directory of Foreign Investment and improve the local investment environment. A broader investment field and better investment environment will ensure FDI flow into China in the long term."

The slow recovery of the world economy, rising costs at home and China's curbs on the real estate industry are jointly responsible for the slide of FDI into China in the first half of this year, according to Shen.

"Uncertainties in the world economy recovery, and the European debt crisis which still lacks a proper solution, affected the investment activities of multinational companies," Shen said.

The World Investment Report 2012 issued by the UNCTAD early this month said that the growth rate of global FDI will slow in 2012 with the value of both cross-border mergers and acquisitions and greenfield investments retreating in the first five months of 2012.

"Rising costs at home, including a shortage of land supply, also affect FDI in China. But the real estate industry is the major force driving down China's FDI expansion in the first half of this year," Shen said.

FDI flowing into China's real estate industry declined by 12.4 percent year-on-year in the first half of 2012 while FDI into China's financial industry surged by 73.3 percent in the same period, according to the ministry.

"The second half of this year will see China's imports pick up speed and the trade surplus in 2012 is likely to be bigger than last year's ($155.14 billion). But the proportion of the trade surplus in China's GDP or the whole-year trade volume will see no big change," Shen said.

lijiabao@chinadaily.com.cn

(China Daily 07/18/2012 page13)