Realty stocks fall as authorities reaffirm curbs

|

People look at a model of a housing development at a property fair in Fuzhou, Fujian province, on May 26. Zhang Bin / For China Daily |

Real estate stocks decreased further on Friday after the authorities reiterated their stance to guard against a possible rebound in housing and land prices, leading to a decline in the benchmark index for the fifth consecutive week.

Local authorities were told to enhance monitoring of the land market in a bid to prevent the sale of land lots with inflated prices, according to a notice jointly released on Thursday by the Ministry of Land Resources and the Ministry of Housing and Urban-Rural Development.

"Adjustments must be made to land sales with a premium rate of more than 50 percent," the notice said.

The premium rate is the percentage difference between the initial and the final price in a land auction.

"Local authorities should prioritize land supplies for affordable housing, and further increase supplies for ordinary commercial residential houses," the notice added.

Local governments were urged to stick to the regulations, and put an end to any flexible measures already published. The notice also called for tougher measures to deal with lots which have been sold but were left unused.

The announcement weighed on the shares of real estate companies on China's A-share market on Friday. A total of 137 listed real estate companies saw their stock prices down 0.55 percent on average.

Led by the weak performance of the real estate sector, the Shanghai Composite Index lost 16.2 points, or 0.74 percent, to close at 2168.64 points. The Shenzhen Component Index tumbled 176.27 points, or 1.85 percent, to close at 9333.21 points.

The ministries' statement came as the nation's housing prices and sales both showed signs of warming up.

Official data released Wednesday showed that 25 cities, out of a statistical pool of 70 major cities, saw new home prices rise in June from the previous month. The figure was drastically up from the six cities that saw month-on-month price gains in May.

Premier Wen Jiabao said earlier this month the government must make unswerving efforts to ensure house prices return to reasonable levels and prevent a price rebound that would undermine the effects of previous efforts.

"Fluctuations have been seen recently in the property and land market. Although they have not changed the overall picture, complexities and instabilities have increased in the market," said the notice.

However, "as the government keeps issuing regulations for the property market, the golden age of the real estate sector is long gone," said Xie Yifeng, head of the Asia-Pacific Urban Real Estate Association.

Since 2010, the government has issued a series of regulations to moderate surging commercial housing prices, including purchase restrictions and tax measures.

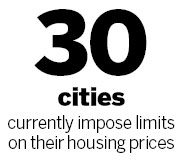

Currently, 30 cities have limits on their housing prices, while 45 cities issued measures to restrict purchases, and more than 600 cities have tightened housing loans.

Meanwhile, two cities are levying property taxes and more than 600 cities are taxing second-hand deals.

"Do not expect that the tightening measures will be relaxed this year. Although they are not the best policies, there is no choice at the moment," Xie said.

Official data showed that housing prices slid more than 10 percent in first-tier cities since the regulation was put in place.

"Even though the property market is now approaching the bottom, it's far from an overall recovery. And it is not likely for the sector to stage a strong comeback amid the economic slowdown," Xie said.

Zheng Mingang, a real estate industry analyst with Dongxing Securities, said the government's latest notice reiterated there wouldn't be any relaxation of the current measures, but that there wouldn't be new regulations added either considering the current economic situation.

"Authorities will make more efforts to strengthen the monitoring of current measures, which will help lessen fluctuations in the property market, and therefore stabilize investors' confidence," Zheng said in a research note.

The shares of real estate companies are expected to face less pressure, and will see upward potential due to increased demand in the second half, he said.

weitian@chinadaily.com.cn

(China Daily 07/21/2012 page10)