Private equity, venture capital firms hit by economic slowdown

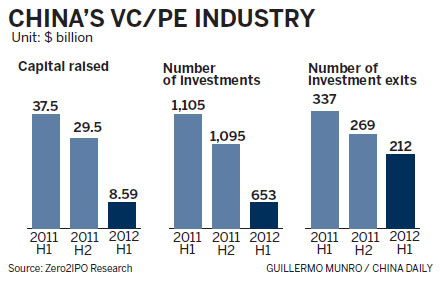

The amount of fundraising and investments by Chinese venture capital and private equity funds plummeted in the first half of the year, as did the number of times they exited investments in companies.

Meanwhile, the prospect is gloomy for Chinese IPOs in the United States this year, according to latest industry reports

As the global economy continues to weaken, Europe's debt troubles become more serious and Chinese economic growth slows, 150 venture capital and private equity funds that can invest in the Chinese market raised $8.59 billion in the first half. That amount was down 77.1 percent year-on-year, said a report by Zero2IPO Group, a company that researches venture capital and private equity.

The report said eight of those 150 funds were foreign.

The first half of the year saw 653 investment deals involving venture capital and private equity in China, a decrease of 40.9 percent year-on-year.

Venture capital funds found the Internet industry to have the most attractive investment prospects, making 72 deals and putting $470.9 million into it in the first half of 2012.

Private equity funds, meanwhile, most liked the medical and health industry, making 23 deals in it from January to June.

Of the 128 Chinese enterprises whose shares were listed on stock exchanges in the first half of the year, about 100 launched IPOs on mainland exchanges. The remaining 24 held them in overseas markets, a number down almost 50 percent year-on-year.

In the same period of 2011, 167 companies launched IPOs on mainland exchanges.

Shan Xiangshuang, chairman of the board of China Science and Merchants Capital Management Ltd, said: "the outlook for venture capital and private equity firms reflects the situation in the Chinese and global economies."

China was home to more than 10,000 venture capital and private equity firms at the end of last year. Those companies managed nearly 2 trillion yuan ($313.9 billion) in assets, according to Liu Jianjun, an official of the National Development and Reform Commission's department of fiscal and financial affairs.

Gu Shengzu, a deputy to the National People's Congress Standing Committee, said investments made in companies that are about to launch an IPO usually produce less returns than do those that are made earlier. Venture capital and private equity firms therefore should put their money into companies that are a long way off from selling shares.

In the first half of this year, only one Chinese company went public in the United States, according to China Venture Group.

Shares in the Chinese online retailer VIPshop, backed by the venture capital firms DCM and Sequoia Capital, tumbled in their US debut in March.

According to China Venture, 43 Chinese enterprises went public in the US market in 2010, raising $4 billion. But Chinese companies have been effectively shut out of North American markets since June 2011, a result largely of short-selling and accounting scandals at some Chinese companies.

caixiao@chinadaily.com.cn

(China Daily 07/26/2012 page15)