Monetary-policy delusions

The politicization of central banking continues unabated. The resurrection of Japanese Prime Minister Shinzo Abe and Japan's Liberal Democratic Party, pillars of the political system that has left the Japanese economy mired in two lost decades and counting, is just the latest case in point.

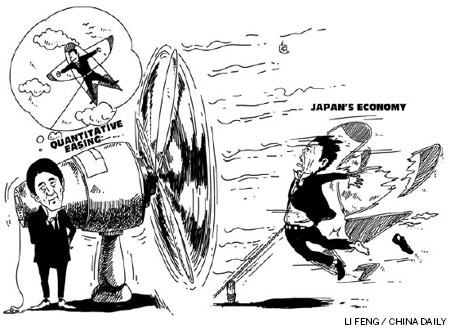

Japan's recent election hinged critically on Abe's views on the Bank of Japan's monetary policy stance. He argued that a timid BOJ should learn from its more aggressive counterparts, the US Federal Reserve and the European Central Bank. Just as the Fed and the ECB have apparently saved the day through their unconventional and aggressive quantitative easing (QE), goes the argument, Abe believes it is now time for the BOJ to do the same.

It certainly looks as if he will get his way. With BOJ Governor Masaaki Shirakawa's term ending in April, Abe will be able to select a successor, and two deputy governors as well, to do his bidding.