A yen to try the balancing act

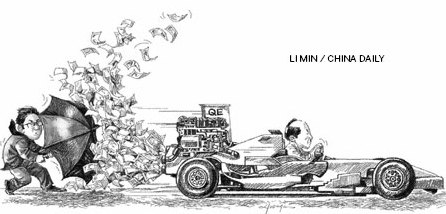

Bank of Japan's new governor, Haruhiko Kuroda, unleashed the world's most intense burst of monetary stimulus earlier this month, promising to inject about $1.4 trillion into the economy in less than two years. The radical gamble sent the yen reeling and bond yields hurtling down south.

For China, the most important issue is the negative impact of the move, that is, whether the yen's depreciation will trigger a currency war. But fears of a "currency war" are unwarranted. According to the currency management system in Japan, called "floating exchange rate system" like in many other countries, the yen always fluctuates with supply and demand. For instance, despite the interference with the dollar, euro and sterling after the outbreak of the global financial crisis, the basic trading rules have remained intact.

Besides, developed countries have an unwritten rule: the priority of making the arrangements lies with the United States. So Japan has to consider other developed countries' interests before devising its currency policy.