Charging facilities vital for NEV growth

The year 2014 will be remembered as a landmark for new-energy vehicle development in China.

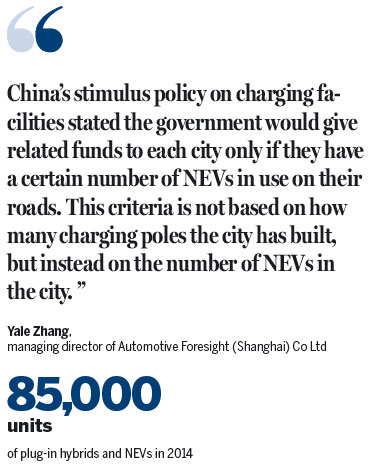

The country produced nearly 85,000 units of plug-in hybrids and NEVs in 2014, 265 percent higher than in 2013, nearing the US new energy vehicle market size of 120,000 units and lifting China's global rank in the NEV market from No 4 in 2013 to No 2 in 2014, close behind the United States.

China's NEV sales were still very weak during the first and second quarters of 2014, with most of the year's 85,000 units produced from September to December, the last four months of the year.

Notably, this growth is not the result of natural market demand, but central government policies and subsidies played major roles in the hike.

Policy drivers

NEVs in China are defined as plug-in hybrid and electric vehicles (including battery and fuel cell EVs).

Basic hybrid cars such as the Prius are not eligible for subsidies in China.

The State Council released its energy conservation and new-energy vehicles plan on April 18, 2012, which gave the target for the number of electric and plug-in hybrid vehicles in operation by 2015 as 500,000 units, with the fleet to rise to 5 million units by 2020.

China's new-energy vehicle development formally started in 2009, when China started the "Ten Cities, Thousand Vehicles" pilot project, and the central government selected 10 cities to take part.

In late 2010, the list was expanded to cover 25 cities, and a target of 30,000 NEV units was set for the end of 2012.

The three-year pilot project, called the Stage-1 NEV demonstration, can hardly be defined as successful.

Few of the cities were interested in spending local funds to subsidize NEVs made elsewhere.

The 30,000-unit target was eventually met, but mostly due to a push by the central government in the second half of 2012.

With this far-from-perfect experience, the central government did not launch the Stage-2 project until September 2013.

At that time, a further 88 cities were selected to purchase nearly 330,000 units by the end of 2015.

During Stage-1, only six cities subsidized individual owners to buy NEVs, according to AutoForesight 2015-H1 China NEV research.

By the end of the first quarter of this year, 27 cities had already issued local policies to subsidize individual customers, mostly by matching central government subsidy amounts.

This brings the subsidy for EVs to nearly 110,000 yuan ($17,717), and PHEVs to about 65,000 yuan per unit.

On top of the direct subsidy, the central government decided to waive 10 percent of the vehicle purchase tax on 377 NEV models from September 2014, which takes the total subsidy value to almost 40 to 45 percent of most NEV retail prices.

In addition, large cities with car plate control policies, such as Beijing, Shanghai, Shenzhen and Hangzhou all give free car plates to NEVs, a value of about 50,000 to 90,000 yuan.

If this value is added in, the total subsidy rate becomes 60 to 65 percent of NEV retail prices.

As well as all the above, three districts in Shanghai also give an extra 20,000 to 30,000 yuan subsidy to individual NEV buyers.

With such large subsidies and, more importantly, a free car plate, although charging facilities are far from ready, individual consumers in the fourth quarter of 2014 were quickly motivated and demand of EVs and PHEVs boomed.

Defective policies

The US and Japan also subsidize NEVs, but control the percentage of subsidy to retail price at between 10 and 25 percent.

China's subsidy ratio of 40 to 65 percent is much higher, resulting in unreasonable NEV retail pricing by some OEMs.

In general, China's NEV retail prices are 30 to 50 percent higher than mainstream NEV prices in the US and Japanese markets.

Another obvious problem of the policy is that some cities give high subsidies while others have not yet published any local policies.

Thus, interest in NEVs is not evenly distributed across the country and, when the subsidies are lifted in the future, sales may slow quickly.

Despite such problems, positive efforts are being made to encourage consumers to purchase NEVs.

However, the charging infrastructure, the most important foundation for all NEVs, lacks clear policy guidance.

The central government planned to have 400,000 charging poles and 2,000 charging stations by the end of 2015.

However, by the end of 2014, local cities had constructed only 28,000 charging poles and 600 charging stations.

Some people argue that the infrastructure and NEVs are like the chicken and the egg, and it is hard to say which should come first.

However, for a country's policymakers, the charging infrastructure should be the higher priority, and it is the responsibility of policymakers to say so loudly.

China's stimulus policy on charging facilities stated the government would give related funds to each city only if they have a certain number of NEVs in use on their roads.

This criteria is not based on how many charging poles the city has built, but instead on the number of NEVs in the city.

It appears the sole purpose of the policies is to increase the NEV population on the road as quickly as possible, and other than that, nothing really matters.

However, if there are no charging facilities or if the facilities' locations are not dispersed well within a city, individual consumers will not buy more EVs.

2014 NEV sales indicated that individual consumers preferred PHEVs to EVs, mainly due to charging difficulties.

The most useful location for charging poles should not be only pilot areas in a city's downtown areas, but they should be dispersed within residential communities.

Individual consumers need to "apply for" permission to construct charging poles from property management as well as the local state grid.

Very often, they are refused immediately when they talk with the community's property management.

Property managers have a thousand reasons to not build charging poles, such as the potential danger of fires, or the fairness of NEV car owners permanently using certain parking lots.

The key issue is that property management companies have no motivation to do anything that will cause them unnecessary trouble.

In addition, community property management companies are usually "tough" and not easy to persuade to do something from which they get no benefits.

The problem here is that it looks like the policymakers do not want to get too involved in this most difficult sector either, but pick the easy path by pushing charging stations in the city, or building many charging poles in certain pilot areas to provide fast charging services, so that these charging facilities can be "seen" easily by people, media and higher ranking officials.

But is it convenient for an EV owner to drive 10 to 20 km to a charging station for fast charging? That question does not seem to be a prime concern at the moment.

Solutions

The government does understand that the large amount of subsidies may result in some "lazy babies" doing nothing but waiting for milk.

Therefore, the subsidies will be reduced gradually until 2019, and there will be no subsidies by 2020, after which OEMs need to stand on their own.

Those who priced their EVs too highly will lose market share, while those who can reduce their costs in the coming five years will gain market share quickly.

However, for charging facilities, there is still no clear road map.

The mid or long term target of 4.5 million charging poles by 2020 was based on an assumption of 5 million NEVs on the road.

However, since this 5 million NEV target is a mirage, one thing that is sure is that neither parties nor stakeholders will be serious about a charging facility target.

If there are no charging facilities, the growth in EVs that China is pushing so hard will not be smooth. The government should cut some of the subsidy funds and shift them to charging facility construction. In addition, community management companies must be confronted with mandatory regulations, and local governments should not hide from this difficult task.

Secondly, community management companies should be given compensation or benefits to help build charging poles, as they will need to provide manpower and address potential issues in the future.

Only by this classic "carrot and stick" strategy, will the development of charging facilities accelerate. By then, EVs will have become family's second cars that are convenient for daily commuting, and PHEVs will experience a real boom also.

(China Daily 04/20/2015 page3)