Huawei ready to support 'Bank 3.0'

To compete and thrive in the digital era, banks and other financial institutions need to respond to increasing customer demand for mobile banking and interaction through digital channels.

In his book Bank 3.0: Why Banking Is No Longer Somewhere You Go But Something You Do, Brett King writes that consumers are now less likely to view their bank in terms of capital adequacy, branch network, products and rates. Instead, they are more likely to determine their banking partners by how easily they can access their accounts when they need to, and how much they trust their provider to execute business on their behalf.

Huawei Technologies Co Ltd, China's leading information and communications technology solutions provider, said traditional banks are facing a new reality with customers moving toward mobile and digital channels.

Current brick and mortar branches can no longer satisfy customers' needs in the new era and digital banking is overtaking physical branches as the preferred way for customers to interact with their bank.

In the "Bank 2.0" era, customers can process 70 percent of services by themselves through e-banking, mobile phone banking, mobile payments, such as Alipay, and mobile phone wallets.

However, subscription services, such as signing contracts, issuing cards and processing loans, still require onsite processes at bank branches.

Banks have to repeat time-consuming processes and customers face inevitable queues and waits to complete these transactions, the company said.

Many banks are taking important steps toward the "Bank 3.0" era. Rapid advances in information and communications technology infrastructure are creating opportunities for banks to develop mobile marketing services that build more loyal relationships with their customers and drive additional revenue.

By adopting real-time access banking systems, remote video collaboration platforms and smart mobile terminals that support real-time customer information collection and authentication, account managers can deliver banking services for customers anytime and anywhere, such as customers' homes, residential communities, central business districts and schools, Huawei said.

With the rise of big data technology, banks are able to stimulate customer purchases through the creation of innovative and personalized mobile advertising and marketing.

For example, using location data from customers' mobile devices, banks can deliver real-time, location-based promotions and services through digital channels such as WeChat.

Mobile banking terminals help banks improve their transactions and sales by offering easy access to banking services in any location including airports, train stations, commercial areas, business districts, clubs and residential communities. This means banking can be done at a time and place most convenient to the customer.

With cyberattacks and data breaches rising, many banking customers have lost trust in traditional credit card marketing campaigns, namely marketing booths with folding chairs and credit card application forms.

To protect consumers' data and prevent fraud in mobile marketing campaigns and transactions, banks need dedicated smart mobile platforms that provide reliable and secure mobile marketing services and prevent unauthorized access to mobile marketing terminals, applications or data.

The adoption of mobile marketing enables various real-time services ranging from onsite identification photo shooting for credit card applications, transmission of credentials to the back office, information authentication, and credit limit authorization. This keeps customers updated on the real-time approval status of credit card applications and credit limits to ensure a reliable and secure experience, which ultimately improves credit card activation rates for the bank.

Smart mobile terminals support multimedia display and information input as well as paperless banking services such as electronic marketing materials and application forms. This significantly shortens new product rollouts from eight weeks to one week, helping banks respond rapidly to market needs.

In addition, smart mobile terminals help banks reduce the service-processing period by enabling the paperless application materials, real-time data transmission and end-to-end digital service operation.

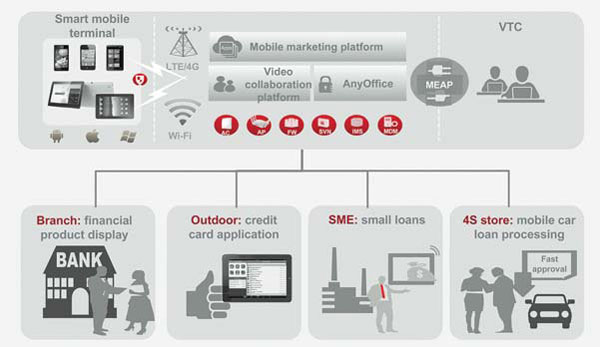

The IT infrastructure of the mobile marketing system consists of five core elements - smart mobile terminals, mobile marketing platforms, video collaboration platforms, mobile security platforms and remote virtual teller centers.

Three of these elements are the touchstones of a bank's IT capability - mobile security platforms, video collaboration platforms and smart mobile terminals.

Data security protection is critical to mobile marketing. Rigorous security control and powerful technology support are required to ensure safe encryption, storage and transmission of data, access control and data protection of lost terminals.

Huawei's AnyOffice platform, part of its Mobile Marketing Solution, supports mobile terminal management throughout the entire cycle, such as, position locating and remote data wiping of lost mobile terminals.

Additionally, the AnyOffice platform provides end-to-end security protection that covers terminal access, separation of public and private data, transmission encryption, and back-end protection against cyberattacks.

Video collaboration is an essential prerequisite for mobile marketing to differentiate from e-banking and mobile phone banking by realizing more comprehensive and ubiquitous financial services.

For the sake of supervision and risk control, some bank services must be signed in front of the cashier at the bank and require authorization of two tellers, such as debit card issuing, personal consumption loan application, e-banking and mobile phone banking contract signing.

Huawei's Mobile Marketing Solution can help banks simplify service operations by providing powerful video collaboration capabilities, such as remote desktop sharing and multi-party conferencing.

Door-to-door mobile marketing requires mobile terminals to support various counter services, such as bill printing and password keyboards, with high portability.

To address this, Huawei has collaborated with its partners to launch an all-in-one mobile terminal, which integrates the capabilities of diverse external devices, including second-generation ID card scanners, stripe card readers and chip card editors, supporting the whole process of service provisioning.

In the 1990s, Bill Gates, founder of Microsoft, predicted that traditional commercial banks would be extinct like dinosaurs in the 21st century.

In the Internet era, commercial banks are developing their virtual "branches" and "counters" by leveraging information technologies and finally to realize the transformation from "bricks" to "clicks".

zhuanti@chinadaily.com.cn

|

Huawei's Mobile Marketing Solution, one of the telecommunications giant's latest efforts to help its users around the world, is a more advanced, real-time access system. Illustrations Provided to China Daily |

(China Daily 06/30/2015 page3)