Chengdu banks on becoming financial hub

Since 2013, when Chengdu became the fourth Chinese city to host the Fortune Global Forum, the city government has shown its ambition to become a center of financial agencies, financial innovation, market trade and financial service in west China.

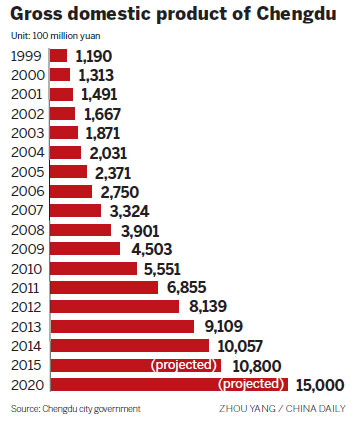

Chengdu's economy grew fivefold in the past 10 years. Last year, its gross domestic product exceeded 1 trillion yuan ($168 billion). It is predicted that the city's economy will increase 50 percent in five years, reaching more than 1.5 trillion yuan by 2020.

The field of finance has played an important role in boosting the robust economic growth, and will have a larger role to play in the city's future.

By December, 268 businesses of the world's top 500 had set up their regional headquarters, research and development centers or factories in the city.

These enterprises operate in information technology, automobiles, telecommunications, equipment manufacturing, biomedicine, engineering machinery and, power generation assembly.

About 80 percent of iPads and 50 percent of laptop chips in the world are manufactured in Chengdu.

Behind those industries is a booming financial industry sector. In addition to Chinese banks, Chengdu has branches of major foreign banks, such as Citibank and Standard Chartered.

By the end of September, Chengdu had 63 banks, 76 insurance agencies, 87 security and futures companies, and 381 registered equity funds. The number of foreign invested banks and insurance companies led all cities in western China, reaching 16 and 17 respectively.

The world's four largest accounting firms - Deloitte Touche Tohmatsu, PricewaterhouseCoopers, Ernst & Young and KPMG - have their regional headquarters in Chengdu. Chengdu has more than 300 law firms, more than 100 asset evaluation agencies and various kinds of insurance broker companies and risk and loss assessment agencies.

In the first three quarters of 2015, the added value of Chengdu's financial sector was 92.9 billion yuan, accounting for 11.9 percent of its GDP and contributing to 3.6 percentage points of the growth of service sectors in the city. The city's outstanding deposits exceeded 3 trillion yuan, ranking first among all cities in west China.

Meanwhile, the outstanding loans totaled 2.24 trillion yuan, up 10.7 percent year-on-year and 2.7 percentage points higher than the city's GDP growing speed. The robust growth of loans indicates the financial sector's increasingly powerful support in the real economy.

Rocketing growth

With strong support from the government and the financial sector, Chengdu is experiencing rocketing growth in new businesses. From January through November, more than 22,400 new ventures were set up in the city, up 36 percent year-on-year.

In the first three quarters of 2015, Chengdu saw another 10 enterprises listed on the stock market, taking the number to 58.

By the end of September, Chengdu had 381 private equity investment agencies and 157 managed funds that totaled 22.38 billion yuan.

The financial office of the city government predicts that the annual added value of Chengdu's financial sector will reach 200 billion yuan by the end of 2020, accounting for 26 percent of the growth of the entire service sector, and 14 percent of Chengdu's GDP. The outstanding deposits and loans will respectively reach 5.1 trillion yuan and 3.8 trillion yuan, both up more than 80 percent from the previous year. The number of listed companies in Chengdu is expected to reach 280, and their direct financing from the stock market is forecast to hit 500 billon yuan, accounting for 50 percent of the total financing scale of Chengdu.

Contact the writers through liyang@chinadaily.com.cn

|

The Bank of East Asia opened its first Chengdu branch in 2004, becoming the first Hong Kong-based bank to invest in the city. |

(China Daily 12/31/2015 page10)