Seniors shun property buyout program

China's older generation has turned its back on 'reverse mortgages', forcing the government to look for new remedies for an aging population and a shrinking pension pot. Chen Mengwei reports.

Editor's note: This is the third in a series of reports China Daily will publish looking at the lives of elderly people, the problems they face and ongoing efforts to improve their standards of living. More stories will be published in the weeks to come.

In late March 2003, Meng Xiaosu, then-president of China National Real Estate Development Group, contacted the central government and enthusiastically proposed a pension product he had seen in the United States.

He was convinced it would revolutionize life for China's retired seniors.

Although Meng received a prompt reply from then-premier Wen Jiabao, he didn't realize that it would take more than 10 years before his product - the reverse mortgage pension program, under which homeowners sell the deeds of their property to an insurance company in return for monthly payments - would be put into practice, or even tested.

The core idea is simple - to turn homes into liquid cash without the owners having to leave the property - and the process is easy to understand.

However, Meng did not imagine that a relatively mature financial product with millions of elderly users overseas would be met with indifference in China not only by buyers, but also sellers.

In 2004, the China Insurance Regulatory Commission was widely reported to be testing the idea in Beijing, Shanghai and Guangzhou, Guangdong province, but the trials were canceled in the face of public indifference.

Since then, a range of similar proposals have been promoted and discussed through various political channels.

Even so, the product remains unpopular. Some people see it as a government attempt to avoid the responsibility of funding an aging population as the national pension pot shrinks, while others refuse to give their homes to anyone other than their children. In China, there is a tacit agreement in many families that the children care for their elderly parents in return for the family home when their parents die.

Essentially, a property owner sells the deeds to their home to an insurance company, which then pays them a monthly income based on the value of the property. When the owner dies, the company sells the home to recoup its investment, with interest of course, and the owner's children share any money left over. If the property is worth less than the purchase price, the company absorbs the loss and the children receive nothing.

"If the insurance service is promoted, policyholders' homes can be liquidated gradually during their lifetimes, so they won't need to worry about life after retirement," Meng told Wen in the letter in which he outlined his proposal.

However, the challenge of an aging population has escalated quickly, to the point where it may hit the country hard, and sooner than many have predicted. By the end of 2014, about 15.5 percent of the Chinese population - more than 212 million people - were age 60 and older, according to statistics from the National Bureau of Statistics.

Moreover, an increasing number of seniors are tapping into the pension reserves, and in some provinces the rate of withdrawals is faster than the pension pot's growth rate.

Exception to the rule

When a proposal gains the approval of China's top leadership, it can usually be accomplished faster than in many other countries, the renowned "China speed". However, reverse mortgages have been an exception to that rule.

Twelve years after the correspondence between Wen and Meng, the first reverse mortgage product was issued by the Happy Life Insurance Co, where Meng was chairman of the board, and was licensed by the insurance regulatory commission to reach certain cities by March 23 last year.

Zhang Jingkang, from Chongqing, said he had heard about reverse mortgages, but is reluctant to buy the product, saying he doesn't want to risk losing his property.

"For most Chinese people, a house is not just a house, but also a home, something to pass to the next generation. I wouldn't mind my children selling it when I'm dead, but it doesn't feel right to do anything while I'm still alive," the 65-year-old retired accountant said. "I know the insurance company said it is safe, but can we trust them with our most precious resource?"

Beijingers Kang Xixiong and his wife Ma Junying joined the project in 2014, and have received a monthly payment of nearly 10,000 yuan ($1,500) since then.

"We signed a contract with the insurance company when they came to our community to promote the project," said Kang, 73, when he was interviewed by China Central Television last year.

After losing their only daughter in 2008, Kang said their apartment had become the couple's financial security. According to the CCTV report, Kang's apartment was worth about 3 million yuan, which would provide the couple with nearly 10,000 yuan a month, in addition to their combined monthly pension of 7,000 yuan.

"With the extra money, we could afford new household appliances, and we have changed our refrigerator," Kang told CCTV. "We are also planning to take a trip overseas."

Strict requirements

However, by the end of July, just 84 people from 64 families had participated in the plan in the selected rollout cities of Beijing, Shanghai, Guangzhou, and Wuhan, Hubei province, according to Dai Hao, assistant president at Happy Life Insurance. In Wuhan, only one couple bought the plan.

Dai attributed the low number of buyers to the company's strict requirements for clients, especially those regarding outright ownership of the property.

"In Beijing alone, we took hundreds of calls from people who wanted to join. But many failed because their ownership certificates did not qualify them to do so. For instance, some people's houses belonged to the military, while some co-owned their homes with their children," he said, adding that the tough application standards are designed to avoid potential legal conflicts with the policyholders' heirs.

Yuan Xucheng, director of the life insurance supervision department at the insurance regulatory commission, said that by June 30, the average policyholder was age 71.6 years, and the average monthly payment was 9,070 yuan, while the highest was more than 20,000 yuan.

At a media briefing in July, Yuan initially acknowledged that some people believe the reverse mortgage trial has failed, and he defended the policy.

"From the trials, we have noticed that the product suits the needs of middle-to-low-income families, parents who have lost their only child, empty nesters and seniors who have lost their spouses," he said.

"However, as long as the product meets the need of a certain group of seniors and provides more choices for pension plans, even if only one deal is reached we will regard it as a success."

Contact the writer at chenmengwei@chinadaily.com.cn

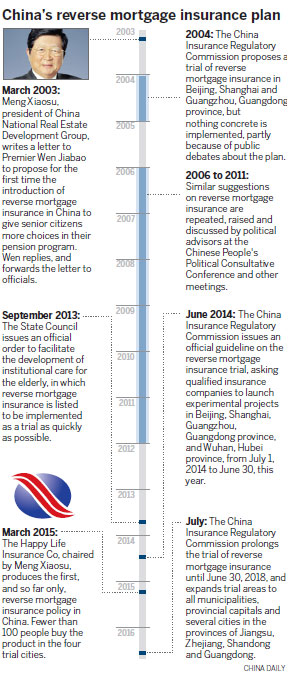

China's reverse mortgage insurance plan

March 2003: Meng Xiaosu, president of China National Real Estate Development Group, writes a letter to Premier Wen Jiabao to propose for the first time the introduction of reverse mortgage insurance in China to give senior citizens more choices in their pension program. Wen replies, and forwards the letter to officials.

September 2013: The State Council issues an official order to facilitate the development of institutional care for the elderly, in which reverse mortgage insurance is listed to be implemented as a trial as quickly as possible.

March 2015: The Happy Life Insurance Co, chaired by Meng Xiaosu, produces the first, and so far only, reverse mortgage insurance policy in China. Fewer than 100 people buy the product in the four trial cities.

2004: The China Insurance Regulatory Commission proposes a trial of reverse mortgage insurance in Beijing, Shanghai and Guangzhou, Guangdong province, but nothing concrete is implemented, partly because of public debates about the plan.

2006 to 2011: Similar suggestions on reverse mortgage insurance are repeated, raised and discussed by political advisors at the Chinese People's Political Consultative Conference and other meetings.

June 2014: The China Insurance Regulatory Commission issues an official guideline on the reverse mortgage insurance trial, asking qualified insurance companies to launch experimental projects in Beijing, Shanghai, Guangzhou, Guangdong province, and Wuhan, Hubei province, from July 1, 2014 to June 30, this year.

July: The China Insurance Regulatory Commission prolongs the trial of reverse mortgage insurance until June 30, 2018, and expands trial areas to all municipalities, provincial capitals and several cities in the provinces of Jiangsu, Zhejiang, Shandong and Guangdong.

How reverse mortgage pensions work

The policyholder must be age 60 or older, and own at least one property.

The policyholder mortgages their house to the insurance company.

The insurance company pays a fixed monthly pension based on the initial valuation of the house, while the policyholder remains living in the property or rents it to a third party.

When the policyholder and their spouse both pass away, the company puts the house up for sale.

The company subtracts the pension paid and the accrued interest from the sale proceeds, while the balance goes to the policyholder's children. If the sale doesn't generate enough revenue to cover the expenses, the company absorbs the loss.

Source: Happy Life Insurance

(China Daily 08/22/2016 page12)