Car-sharing picks up speed

Efficient use of resources, space spur on optimistic industry, but books remain in the red for now

Car-sharing is expected to accelerate in China as authorities are encouraging growth in the sector.

"We should fully understand the role of developing car-sharing," said the Ministry of Transport and the Ministry of Housing and Urban-Rural Development in a document released on June 1 to seek public opinion.

"It offers a new alternative to urban mobility. It will alleviate the pressure brought about by the rapid rise in the number of private cars in cities and subsequently rising demand for roads and parking lots."

|

A customer in Guangzhou, Guangdong province, scans the code of Gofun shared cars from Shouqi Group. Zhu He / For China Daily |

The two ministries also urged local authorities to position the role of car-sharing in a reasonable way in order to build a diversified urban transport system.

The Ministry of Industry and Information Technology expressed its approval of the business even earlier.

In late April, Miao Wei, minister of industry and information technology, said, "We should attach great importance to car-sharing, which can not only improve car use, but also reduce traffic congestion and cut emissions". Miao made the remarks as the ministry released guidelines on China's medium and long-term car industry development.

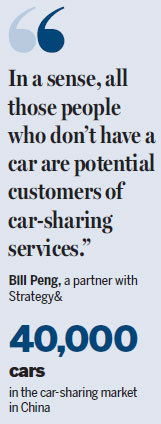

The sector is still in an embryonic stage in China. Statistics show there are now 40 car-sharing companies with a total fleet of 40,000 cars, most of which are new energy vehicles.

Yet industry insiders are optimistic about the sector's prospects.

The fleets of such service providers are expected to reach a collective 170,000 cars by 2020, according to a report by Strategy&, a subsidiary of PricewaterhouseCoopers.

The figure represents a more than 50 percent average annual growth rate from about 30,000 cars in early 2016.

A Strategy& survey showed that 75 percent of users would like to use more of the service, while 77 percent of those who have not used the service yet would like to give it a try.

"In a sense, all those people who don't have a car are potential customers of car-sharing services," said Bill Peng, a partner with Strategy&.

A 2016 study by China's State Information Center showed that a shared car can cut 13 car purchases. China now has more than 200 million cars on its roads, with 150 million of them private cars, according to the Ministry of Public Security.

Car2go, a business under German car group Daimler, has deployed 1,000 vehicles in several large cities including Beijing, Shanghai, Shenzhen, Chongqing, Chengdu, Hangzhou and Guangzhou.

Flexible car-hiring could save consumers the trouble of getting hold of license plates in cities that limit the numbers they release, such as Shanghai and Beijing, said Chen Bing, CEO of Car2go China.

Chen said her company will introduce more vehicles for rental this year, while continuing to add more vehicles in the seven cities it currently covers, and expanding parking and pickup locations.

Hubertus Troska, member of the board of management of Daimler responsible for China, said recent advancements in technology have vastly accelerated the possibilities in shared mobility, with modern cities taking the lead in implementing new ways to get around.

"Especially for us living in China, we observe how strong the sharing trend has become.

"The latest boom in bike-sharing in China is just unbelievable, and it's another indication that car-sharing will become even more popular," said Troska during an interview at the Shanghai auto show in April.

Wei Dong, CEO of car-sharing company Gofun, believes that as shared cars increase, there will eventually be fewer cars on the road.

Wei said: "We see hundreds of cars parked around office buildings for hours until the owners drive them home after work. It is a total waste of resources".

Gofun aims to be available in 20 cities and provide more than 15,000 cars nationwide by the end of 2017.

Despite the prospects, almost all car-sharing providers' books remain in the red, with each car losing 50 yuan to 120 yuan a day, according to Strategy&.

Gao Yu, vice-president of Lifan Motors, said car-sharing, like any business, needs time and scale to make money.

Peng at Strategy& suggested that companies keen to stand out from competitors are preparing for long-term development by securing an adequate number of license plates, parking lots and charging posts.

He said competition will become fiercer over the next two years as car-sharing services gradually expand into smaller cities, and the segment, after rounds of mergers and acquisitions, will see three to four dominant players emerge.

lifusheng@chinadaily.com.cn

(China Daily 06/05/2017 page18)