Hungary and Visegrad Group - the growth engine of Europe

This article is written by Governor of the Magyar Nemzeti Bank Gyorgy Matolcsy and Chief Economist and Executive Director of the Magyar Nemzeti Bank Daniel Palotai.

Hungary has become one of the strongest growing economies in Europe. A decade ago, it was one of the most vulnerable economies.

The Hungarian government has implemented bold reforms since 2010 and the Magyar Nemzeti Bank, or MNB, which is the central bank of Hungary, has created a supportive environment for economic growth. Since 2010, the main goal of economic policies has been to achieve economic balance and growth at the same time.

A major tax reform was the key to the Hungarian success story. The tax burden was shifted away from labor by the introduction of a 15 percent flat tax on personal income with significant family allowances. The new tax system helped decrease the unemployment rate from 11 percent to 4.3 percent by the end of 2016, which remains a historically low rate. The corporate income tax rate also has been decreased to 9 percent, which is the lowest corporate tax rate in the European Union.

Thanks to the reforms of the Hungarian government and the central bank, the three major credit rating agencies - Standard & Poor's, Moody's and Fitch Ratings, upgraded Hungary to investment grade in 2016. Moreover, Fitch Ratings and Standard& Poor's raised Hungary's ratings again in February 2019.

Hungary is a member of a group of countries within the European Union, namely the Visegrad Group, which have been able to maintain their high economic growth for more than half a decade. They continue to converge toward more advanced countries. Nowadays the Central-European Visegrad Group, formed by the Czech Republic, Hungary, Poland and Slovakia, has become the growth engine of the European Union. For roughly two decades, the economic weight of the Visegrad countries within Europe has more than doubled. The region grew by more than 5 percent in 2017, whereas the growth rates of the advanced European countries were approximately 2 percentage points.

All the countries in the Visegrad Group have made huge strides in stimulating employment. The historic trough of unemployment and higher employment show that most Visegrad countries have come close to full employment, or even reached it, as Hungary did.

Hungary has traditionally maintained excellent and diverse relations with China. In recent years it brought these relations to a higher level. The bilateral economic relations reached the level of strategic partnership by 2017. This is due to the Eastern Opening Strategy of the Hungarian government announced in 2011, the strategic agreements made by Chinese companies and Hungary's commitment to the Belt and Road Initiative.

The dynamic and sustainable growth of Hungary creates an opportunity to reinforce its role as a bridge between East and West. The Hungarian government committed itself toward the new era of globalization. Hungary was the first member state of the European Union to join the BRI.

Hungary's government and the central bank of Hungary have strongly promoted internationalization of the Chinese currency. The MNB was the first in continental Europe to sign a bilateral currency swap agreement with the People's Bank of China in order to aid trading and investment relations. Hungary was also the first central European country to issue a dim sum bond.

The central bank of Hungary launched its own comprehensive Renminbi Programme in 2015, symbolically on the first day of the Chinese New Year. The Central Bank of Hungary - in line with the international practice, but prior to the International Monetary Fund's decision on the inclusion of the RMB in Special Drawing Rights basket - has decided to build up its own Chinese bond portfolio. The MNB has also launched the Budapest Renminbi Initiative, offering a multilateral platform for all those market participants, corporate and bank executives and government representatives, who are involved in Hungarian-Chinese real economy and financial relations. In Hungary, the Bank of China has been designated as the RMB clearing bank of the Central-Eastern Europe region, which was a significant milestone in the development of RMB clearing and settlement infrastructure. RMB banking services are available in Hungary and have seen significant development in recent years.

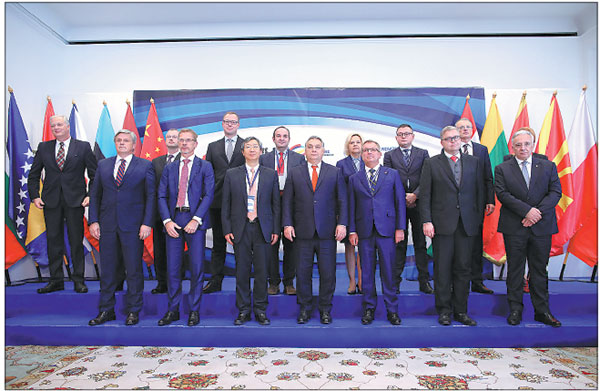

The central bank of Hungary and the People's Bank of China jointly organized the first "16+1" summit of central bank governors from China and the Central and Eastern European countries in Budapest in 2018, where Governor Yi Gang delivered the welcome address. The event further strengthened Hungary's leading role in developing financial and central bank relations in the CEE region consisting of 16 countries with China.

In 2018, MNB, Fudan University in Shanghai and the Corvinus University of Budapest concluded a trilateral partnership agreement on a Fudan-Corvinus double degree Master of Business Administration university course developed with the MNB's professional support. The agreement was signed at the Pre-Forum Session of the Shanghai Forum 2019 conference in Budapest, organized as a joint effort by the central bank of Hungary and Fudan University.

In the framework of the academic cooperation, the Financial and Economic Review, a social science journal of the MNB, publishes the popular papers in the Chinese-language issue once a year.

Hungary is an attractive investment destination in many aspects. As a result of remarkable and sustainable economic growth, Hungary is focusing on further reforms to boost competitiveness and expand its role in the region. Chinese investments are expected to play an important role in these developments. Hungary has a well-qualified workforce, highly developed infrastructure and offers a significantly low corporate tax rate of 9 percent. This is the lowest in the European Union.

Hungary is located in a favourable geographical position as well, as it is situated along the New Silk Road. All in all, there are opportunities in many fields in the heart of Europe. Hungary has huge potential for business.

|

The 16+1 China-CEEC Central Bank Governors' Meeting takes place in Budapest in November 2018. |

|

Left: The Chain Bridge in Budapest, capital of Hungary. Right: The Governor of the People’s Bank of China Yi Gang and Governor of Magyar Nemzeti Bank Gyorgy Matolcsy, shake hands. Photos provided to China Daily |

(China Daily 04/27/2019 page28)