Ex-IMF official argues why crisis left dollar strong

By Yang Yang ( China Daily ) Updated: 2015-09-02 09:49:45

|

|

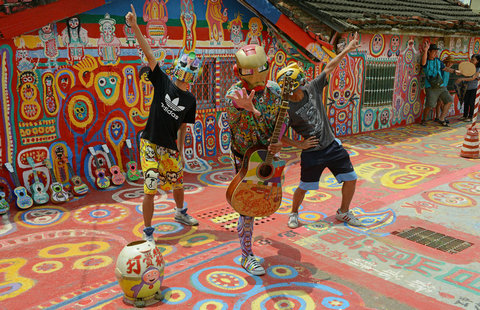

Eswar S. Prasad, former director of IMF's China division, was in Beijing for the launch of the Chinese edition of his book The Dollar Trap.[Photo provided to China Daily] |

Since the outbreak of the global financial crisis in 2008, one question that has been frequently asked: "Is the dominant position of the dollar being threatened?"

In 2008 and 2009, the financial system in the United States nearly broke down. With no effective policies, plus the new competitor RMB on its road to internationalization, it has been predicted that the dollar as the major reserve currency might be replaced.

But, in The Dollar Trap, whose Chinese edition was published in August, author Eswar S. Prasad argues, to the contrary, he says, the global financial crisis, the disordered international money system and the US government's policies have, in fact, consolidated the position of the dollar.

Prasad, 50, former director of IMF's China division, has been studying global currencies for decades. He is now a Tolani senior professor of trade policy and economics at Cornell University.

"This is not a book I planned to write," he says at the book launch ceremony during the 22nd Beijing International Book Fair.

"When I started writing, I was planning to talk about how the global financial crisis started in the US, and whether it meant that the dollar was going to lose its primacy in global finance very quickly," he says.

But in doing research, he was surprised to see numbers indicating that after the global financial crisis, the dollar's position became even stronger.

"Why did this happen?" he asks.

"It's not because the US economy is wonderful and strong, but simply because it's stronger than the rest of the world," he says.

|

|

|

|

|

|

|

|

Raymond Zhou:

Raymond Zhou: Pauline D Loh:

Pauline D Loh: Hot Pot

Hot Pot Eco China

Eco China China Dream

China Dream China Face

China Face