Focus: Escalating pressure on yuan revaluation

( 2003-11-04 09:22) (China Daily HK Edition)

The US economy has been in a slump for the past few years. Jobs in sectors such as manufacturing and even the information industry are vanishing. A possible re-emergence of the "New Economy" of the Clinton administration has only been glimpsed this year following a spectacular bubble burst. Meanwhile, the shadow of economic malaise lingers, and some US states feel it more keenly than others.

Chinese visitors check out US-made security equipment at an international exhibition on public safety and security in Beijing. China is a huge market for US high-tech products. [Reuters] |

As American manufacturing faces its worst crisis since the 1930s, the search for a culprit leads to not only railing against "fate" but also perceived opponents. China, in its economic ascent, becomes a natural target. With international attention focused on China's currency exchange rate, trade issues between China and the US have been quickly politicized and oversimplified to fit the needs of politicians.

Washington politicians are tripping over one another in the scramble to call for various forms of restrictions or sanctions against Chinese imports. The US media have also painted an exaggerated and detrimental picture of China's presumed role in the problem.

With both presidential and congressional elections around the corner in 2004, candidates seeking election or re-election in the US must now appear concerned about their constituencies in the midst of a stagnant economy. In order to show that they care about the public without having to accept responsibility for the situation, they exert pressure on the administration over trade issues. Such strategies abound in an election year - it's all about politics, and a politicized controversy is much easier to handle.

This is the backdrop against which the trade and currency issues relating to China have flared up in the past two months. Political interest groups, public leaders, protectionist groups and non-governmental organizations are all driving the trend. Economic researchers and think-tank analysts, meanwhile, whose expert opinions rarely translate into catchy, media-friendly sound bites, seem to have disappeared.

Trade conflicts do exist between China and the US. However, the two economies are complementary in nature. Competition and trade imbalances are problems that can be resolved. Previous Sino-US trade wars revealed that trade conflicts go hand in hand with trade growth. From an economic perspective, these squabbles may eventually bring the two economies closer, like a pair of lovers whose bickering leads to greater understanding and, ultimately, marriage. But simplistic, unilateral and politicized actions will damage the "relationship" and are to be avoided. Some of the "blame-China" proposals are quite extreme, including one that calls for complete revocation of normal trade relations.

Economical with the truth

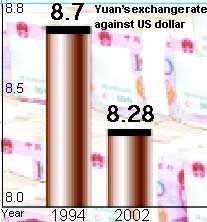

How do economists and other researchers view the Chinese currency exchange rate? Robert Mundell, the "American father of the euro" and a 1999 Nobel Laureate in Economics best known for his analysis of monetary and fiscal policy under different exchange rate regimes and his analysis of optimum currency areas, said that there was no theory advocating balancing trade with exchange rates. A world-renowned US ratings organization asserted that raising the exchange rate for the renminbi could destabilize the international financial market.

Robert Mundell, the "American father of the euro" and a 1999 Nobel Laureate in Economics, said that there was no theory advocating balancing trade with exchange rates. [newsphoto.com.cn/file] |

Balancing an exchange rate is a delicate matter. Any politically charged solution can only create more chaos. Artificial appreciation of the yuan will nominally blow up China's economy overnight, turning it into an inflated economic "fat man". But the eventual slimming process to return to normal will be harmful to Asia and the rest of the world.

Japan's currency policy offers both positive and negative lessons. In the 1950s, Japan insisted on a low-rate policy and was reproached for "currency dumping". As many as 25 GATT members cited "non-application clauses" to deny Japan most-favoured-nation status. But Japan did not yield to the pressure. As a result, it enjoyed decades of high growth and transformed itself into Asia's economic powerhouse.

In the aftermath of the 1985 "Plaza Accord", the yen began a steep climb, followed by a gigantic economic bubble, a resounding crash and a decade-long slump. Even though economic peaks-and-troughs are caused by multiple factors, the currency rate is more than the "straw that breaks the camel's back".

Rapid appreciation of the yuan and increased US import tariff are bound to result in a double-edged sword that will hurt both parties. Trading partners are so interlinked that if one is weakened, it affects the other.

Inflating the yuan will not only blunt China's economy but also impede its exponential market growth, which is increasingly fuelling the world's economic locomotive. Slowing Chinese exports will eventually slow growth in China, nullifying the prospect of the Sino-US free trade envisioned and negotiated by both governments.

Trade tangle probe

The opinions expressed herein may not be new, but they reflect our understanding of trade issues that exist between the two nations:

US Commerce Secretary Don Evans (right) listens to Jimmy Huang, president of Raytek (centre) explain the testing procedure for non-contact thermometers during a visit to the Raytek factory, a Sino-US joint venture company, in Beijing. [Reuters] |

The US economy is service-oriented and its temporary difficulty has little to do with China or trade with China. According to customs figures, the growth in China's trade surplus with the US is accompanied by a drop in trade surplus among the US' other Asian trading partners. From the viewpoint of US manufacturers, only the source of competition has changed, but "the burden is as heavy as before". The costs will not be affected by trade negotiations.

Opening up China's market has always been the focus of these negotiations. Conflicts will always exist. Open communication and proper procedures to resolve the differences are essential.

Trade is not a "zero-sum game". A trade deficit with China is economically beneficial to the US. After Japan, China is the second largest purchaser of US federal bonds. China does not hoard its gains. It uses its export-induced foreign currency to buy federal bonds from the US, thus lending money to the US and backing up the US economy. The US has never been, and will never be, the loser here.

The trade imbalance is temporary. Trade has transformed China into a huge market of which the US is the biggest beneficiary because the US produces those goods that China needs most, such as aircraft.

The Bush administration has, so far, been calm and even-handed in dealing with the China trade and currency controversy, refraining from radical words or actions. In congressional hearings, government officials have generally not veered from the truth of the matter. But with elections nearing and pressure escalating, there have been signs of impatience. Last month, the Ministry of Commerce set up a new team to "take care" of China-related trade issues, as if the trade representative was not doing a good job.

On October 24, US Treasury Secretary John Snow turned up the tone of his remarks on China a notch. President George W. Bush is also gearing up for his re-election campaign and looks poised to shift into high gear on his China trade-related criticism. The Bush administration is expected to drag out all the old issues and initiate another round of trade talks. If deemed necessary, a Section 301 inquiry into Chinese trade practices will begin and barriers to market entry will be set.

Political pressure, coupled with simplistic responses from political leaders, may force the issue onto the wrong track. In the midst of all the commotion, a leader will show his true mettle and insight. Vision can withstand the test of time. But as the American economy and politics currently stand, we are not optimistic about the outcome.

Escalating pressures

Aug 29 - Some 80 US trade organizations call for a Section 301 inquiry to determine whether the yuan's exchange rate constitutes unfair trading practices.

Sep 1 - In his Labour Day speech, President Bush expresses his willingness to push for the convertibility of some foreign currency.

Sep 2 - Treasury Secretary John Snow chooses to sit on the fence in his IMF speech, saying a free-floating yuan is good for China's central bank and will help China's economy withstand both internal and external shocks.

Sep 3 - UNITE, a union representing 250,000 apparel, textile, laundry and distribution workers, announces a grassroots lobbying campaign to slow the surge of Chinese imports.

Sep 5 - The US Senate passes Resolution 1586 to demand currency negotiations with China within 180 days under threat of introducing sanctions.

Sep 10 - House Resolution 3058 is proposed to curb what it terms "China's currency manipulation". The Treasury Secretary is asked to assess the situation and impose an additional tariff if necessary.

Sep 11 - A Senate hearing is held on US-China relations.

Sep 26 - Senate Resolution 219 is passed to encourage China to establish a market-based valuation of the yuan.

Oct 1 - The House Committee on Financial Services discusses the opening of China's financial market.

Oct 2 - Congress receives Bill 3328, which requests the revocation of normal trade relations with China.

Oct 3 - The US-China Business Council issues its assessment of China's WTO compliance.

Oct 16-17 - A House committee holds a hearing to discuss China's role in the world economy and its trade commitments.

Oct 20 - The US Senate proposes Resolution 1758 asking the Treasury Secretary to report on "China's currency manipulation".

Oct 21 - The US Congress holds a hearing on reassessing US-China economic ties.

Oct 31 - the US Treasury Department report said that China is not manipulating its currency to gain unfair trade advantages. However, Snow said the Bush administration would continue to keep up its diplomatic pressure on China to drop its tight peg to the dollar.

|