|

Big tariffs vs China a bad idea for US

(Agencies)

Updated: 2005-06-24 09:09

Raising tariffs against China for its refusal to let the yuan rise would hurt

the U.S., Federal Reserve Chairman Alan Greenspan and Treasury Secretary John

Snow told lawmakers Thursday.

Speaking in front of the Senate Finance Committee, Greenspan said new tariffs

on imports would do little to protect U.S. manufacturing jobs or cut the trade

deficit.

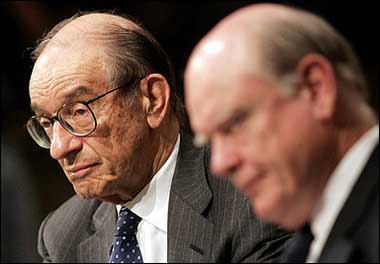

US Federal Reserve

Board Chairman Alan Greenspan (L) and US Treasury Secretary John Snow

testify before the Senate Finance Committee on Capitol Hill in Washington,

DC. They warned lawmakers worried about China not to retreat to

'protectionism.' [AFP] | "Some observers

mistakenly believe that a marked increase in the exchange value of the Chinese

renminbi (yuan) relative to the U.S. dollar would significantly increase

manufacturing activity and jobs in the United States," he said. "I am aware of

no credible evidence that supports such a conclusion."

Instead, he said, protectionist laws would boost imports from other Asian

nations and could push import prices up enough to hurt the U.S. standard of

living.

But Congress is in a foul mood. In April, 67 senators voted for a measure to

slap 27.5% tariffs on Chinese goods if Beijing doesn't revalue the yuan soon.

China's yuan has been set at 8.3 to the dollar for a decade. Some U.S.

lawmakers and manufacturers argue that vastly undervalues the currency. That,

and starkly lower labor costs, let Chinese companies undercut U.S. rivals.

Tariffs Bad, But We'll Do It

Facing domestic pressure, the Bush administration has become more aggressive

vs. China.

Snow said the U.S. might be forced to impose tariffs if the peg isn't

loosened. He said if no move happens by his next currency report in October, the

U.S. will act.

The U.S. last month imposed emergency tariffs on Chinese textile imports,

which jumped after global quotas were lifted on Jan. 1.

But Greenspan and Snow echo the Bush administration's line that tariffs

aren't the answer to reducing trade imbalances.

Snow said isolationist policies "would be ineffective, disruptive to markets

and damaging to America's special role as the world's leading advocate for open

markets and free trade."

But Snow and Greenspan said a revaluation is needed to let the Chinese

currency catch up with years of hot economic growth.

"China is now ready and should move without delay in a manner and magnitude

that is sufficiently reflective of underlying market conditions," Snow said,

noting his frustration at Beijing's inaction.

He also warned tariffs would mean retaliation against U.S. exports, and said

it would do little to lessen the current account deficit, which hit $666 billion

in 2004 and continues to climb.

Greenspan expects China to adjust the yuan to a more sustainable level

"sooner rather than later."

Economists have predicted all year that China would revalue its currency, at

least a bit. But China has offered few hints that such a move is in the works.

Deepening U.S.-China ties were highlighted Wednesday after Chinese oil giant

CNOOC offered to buy Unocal for $18.5 billion. That is $1.5 billion more than an

earlier bid from Chevron. It would be the largest international takeover by a

Chinese company ever.

Several Republicans were quick to oppose CNOOC's offer. House Resources

Committee Chairman Richard Pombo, R-Calif., warned the deal "could come with

disastrous consequences for our economic and national security."

Snow said his review would include the security

implications.

|