|

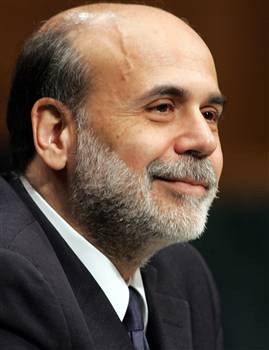

Bernanke sworn in as 14th Fed chairman

(AP)

Updated: 2006-02-02 08:48

Some analysts, however, are worried that the Fed may have to go further than

one more rate hike if inflation pressures get out of control.

Stephen Stanley, chief economist at RBS Greenwich Capital, said he believed

the Fed would not only raise rates in May but perhaps as many as three more

times after that

“We look for strong economic figures and a gradual pickup in core inflation

to force several more moves this year,” he said.

This 15 November

2005 file photo shows Ben Bernanke in Washington,

DC.[AFP] |

However, analysts in the one-more-and-done camp argue that the economy is

already slowing as rising interest rates begin to cool the red-hot housing

market. If the Fed overdoes the tightening, it could cause a more severe slump

in housing.

“That could really crimp consumer spending and hold back economic growth,”

said Greg McBride, senior financial analyst at Bankrate.com, an online financial

service.

One hint, these analysts say, that the Fed is close to ending its rate hikes

was a small change in the wording of Tuesday’s statement. The Fed said future

rate increases “may be needed” to fight inflation, when in December the Fed said

such rate hikes were “likely to be needed.”

More about the Fed’s intentions will be known on Feb. 15 when Bernanke is

scheduled to give the Fed’s twice-a-year monetary report to Congress. Analysts

look for him to signal a strong bond with Greenspan, especially in the area of

fighting inflation.

In saying good-by on Tuesday to hundreds of Fed staffers at a reception,

Greenspan told them they had an important job to do in protecting the dollar

against the ravages of rising prices.

“We are in charge of the nation’s currency,” Greenspan said. “The central

bank, because of that, is involved in everyone’s daily lives. We are the

guardians of their purchasing power.”

|