|

| The Federal Reserve on Tuesday raised interest rates to the highest in four years and signaled it still had leeway to tighten monetary policy, while data showed factories ran at a robust pace in October. |

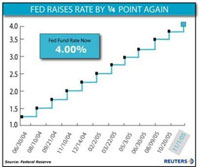

The Federal Reserve on Tuesday pushed its target interest rate up to 4 per cent, highlighted concerns about inflation and said it expected to continue tighteningmonetary policy.

The policymaking Federal Open Market Committee repeated its judgment that, following the increase, monetary policy still remainedaccommodativeand said it expected to continue raising rates at a "measured" pace. It was the 12th consecutive quarter point rate increase, stretching back to June of last year.

Financial market reaction was limited after a decision that was widely expected, with a slight drop in bond prices and rises in stocks and the dollar.

The Fed said that high energy prices and hurricane-related disruptions had temporarily depressed output and employment.

"Monetary policy accommodation, coupled with robust underlying growth in productivity, is providing ongoing support to economic activity that will likely be augmented by planned rebuilding in the hurricane-affected areas," the FOMC statement said.

It again highlighted inflation risks, saying the "cumulativerise in energy and other costs have the potential to add to inflation pressures" while adding thatcore inflationand longer-term inflation expectations remained contained.

The stress on cumulative energy price increases adds to the impression that a chief concern is a potential pass-through to core inflation after a sustained climb in the oil price.

The impact on core inflation has been limited to date. But the 2 per cent rise in the Fed's preferred measure of core inflation in the two months to September is already at the top of the 1-2 per cent "comfort range" popularised by former Fed governor Ben Bernanke.

Mr Bernanke has been nominated to replace Alan Greenspan as Fed chairman. There will be two more meetings of the FOMC, in December and January, before Mr Greenspan is scheduled to step down.

The Fed's vote to raise interest rates and signal its intention of continuing to raise rates came in aunanimousvote.

While some Fed policymakers think the notion of removing policy accommodation is stale, the current outlook retains majority support among the committee.

At 4 per cent, the federal funds rate is no longer obviously a long way below the so-called "neutral" level where monetary policy neither restricts nor stimulates the economy.

(Agencies)

|