-

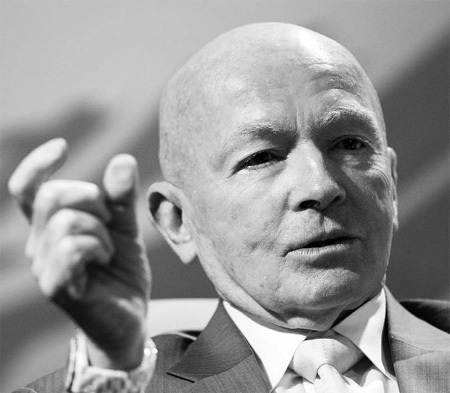

Mark Mobius, chairman of Templeton Asset Management Ltd, speaks at a conference in Singapore. Mobius said Dubai would be 'bailed out' by its neighbors. Bloomberg News

LONDON: Emerging-market stocks rallied for a third day, led by Qatar, as concern diminished that Dubai will default. The yen weakened on speculation Japan will act to curb its gains and the dollar fell, driving gold to a record.

The MSCI Emerging Markets Index rose 0.7 percent in early London trading, heading for its longest winning streak in three weeks. Qatar's DSM 20 Index jumped 5.3 percent. The yen declined against all 16 most-traded currencies, while the dollar weakened versus 14 and gold touched $1,217.23 an ounce in London.

Mark Mobius, who oversees more than $30 billion as chairman of Templeton Asset Management Ltd, said that Dubai will be "bailed out" by its neighbors. Prince Alwaleed bin Talal, the billionaire Saudi investor, said Middle East economies won't be "shaken" by the crisis.

He said banks that loaned money to Dubai World can't claim to be victims of the emirate's debt crisis because they should have understood the risks.

"These banks are very mature banks, and they have to differentiate between a corporate loan and a sovereign loan," Alwaleed, 54, said.

"When things go sour, you can't have some banks in the West going to Dubai and saying 'oops' and crying wolf and saying, 'You should have guaranteed those loans'."

Alwaleed said confusion over whether the Dubai government would back Dubai World's debt "was not helpful at all" and damaged investor confidence in the region.

"However, you have to understand that other countries such as Saudi Arabia, Qatar and neighboring Abu Dhabi are countries to be reckoned with," Alwaleed said. "With the price of oil where it is now, I don't think their economies will be shaken at all."

Dubai's debt rescheduling will have only a minor effect on the euro region's economy, Luxembourg's Jean-Claude Juncker said after leading a meeting of European finance ministers in Brussels.

More to go

"We've got more to go" for the rally in emerging markets, said Mobius, who favors United Arab Emirates developers including Emaar Properties PJSC that tumbled more than 10 percent this week.

"We're going to see a very fast recovery, and the results of companies' earnings are going to surprise on the upside."

Benchmark equity indexes in China, Egypt and Turkey climbed more than 1 percent, while the extra yield investors demand to own emerging-market bonds over US Treasuries fell for a second day.

Government-owned Dubai World will meet its main creditors next week to discuss a request to delay payment on $26 billion in debt that has shaken global markets and confidence in the Gulf Arab business hub.

The meeting would be the first formal encounter between Dubai and key lenders since the conglomerate that spearheaded Dubai's rapid growth disclosed its debt woes on Nov 25.

The yen lost 0.9 percent against the euro and 0.8 percent versus the dollar after Japanese Prime Minister Yukio Hatoyama was cited by the Nikkei newspaper as saying the currency's strength can't be left as it is. Chief Cabinet Secretary Hirofumi Hirano said later Hatoyama wasn't suggesting the government is ready to intervene. The yen has strengthened 3.8 percent versus the US currency this year and traded at a 14- year high of 84.83 per dollar on Nov 27.

Japan should "call for international intervention" to stem the yen's advance, Financial Services Minister Shizuka Kamei said.

Greenback falls

The dollar lost most against the currencies of commodity-producing countries, dropping 0.6 percent versus Norway's krone and 0.4 percent compared with the New Zealand dollar.

Gold for immediate delivery rose as much as 1.7 percent in London, extending its annual jump to 38 percent. Silver, platinum and palladium also gained.

Among industrial metals, aluminum for delivery in three months advanced 1.1 percent to $2,127 a metric ton on the London Metal Exchange. Crude oil for January delivery fell 0.5 percent to $77.98 a barrel in New York.

The MSCI World Index of 23 developed nations' stocks was little changed.

Asian stocks rose for a third day, lifting the MSCI Asia Pacific Index to a six-week high. BlueScope Steel Ltd, Australia's largest steelmaker, jumped 2.8 percent in Sydney after saying demand is improving.

European stocks

Europe's Dow Jones Stoxx 600 Index was little changed. Banking shares declined after Credit Suisse AG said UK banks are "still not cheap enough" after a 9.9 percent drop for the FTSE 350 Banks Index since this year's high in September. HSBC Holdings Plc, the region's biggest lender, dropped 1.5 percent in London. Royal Bank of Scotland Group Plc, the UK's largest state-controlled bank, tumbled 5.7 percent.

Bloomberg News-Reuters

(China Daily 12/03/2009 page17)