Designers cash in on celebrity babies

Now, over one-third of the fourth floor at Plaza 66 is dedicated to foreign luxury brands for kids – Armani Junior, Moschino Baby, Young Versace – as luxury retail sales across the country have been hit by a wide-ranging clampdown on graft and gifting with public funds, compelling retailers to diversify their revenue streams.

The Chinese mainland's luxury goods market slowed from 7 percent growth in 2012 to around 2 percent in 2013, and is expected to see zero growth this year, according to two luxury studies released by Bain & Company, the most recent being in October.

Watches and menswear were particularly hit by the anti-graft campaign, with the growth momentum shifting to women's categories and fashion, it added.

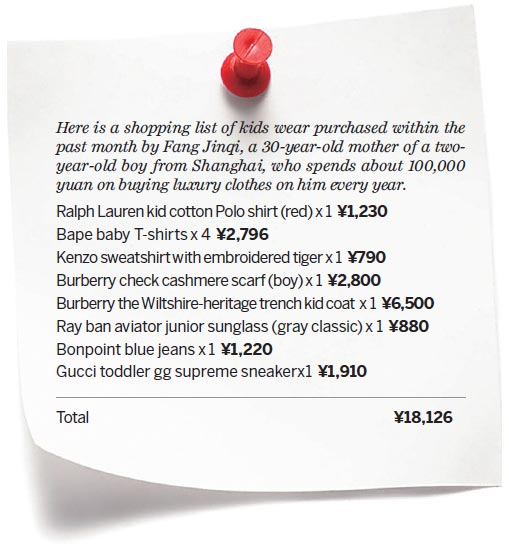

The good news for retailers is that they can earn higher profits on kids' clothing because less material is used but the prices aren't much lower, say researchers at the University of International Business and Economics in Beijing.

Even Ferragamo recently launched a mini-selection of girls' shoes in two classic ladies' designs in Shanghai.

"The baby and kid luxury market is very likely to continue growing at a faster clip than the rest of the luxury market in China as a result of the recent slowdown," says Javier Calvar, COO of Albatross Global Solutions, a Hong Kong-headquartered marketing services provider.

"This is because Chinese parents would rather stop buying for themselves than for their children," he adds.