Wine industry still bullish on China

|

|

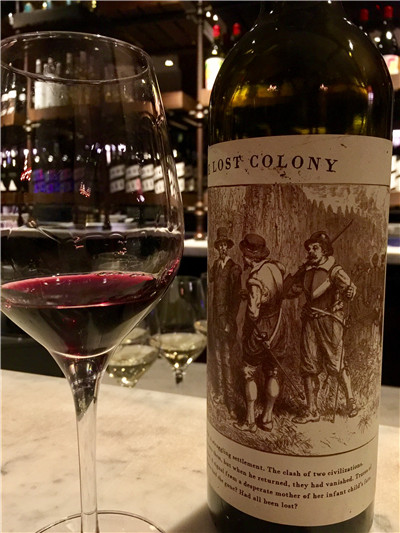

Wine Vision offers global wine pros a taste of Sonoma county vintages like this one (left) from Francis Ford Coppola's winery. [Photo by Mike Peters/China Daily] |

Cautious enthusiasm for the Chinese wine market. More men in supermarkets. Opening a bottle of wine with your shoe.

Those were some of the takeaways at Wine Vision, an annual forum for the industry hosted last month by Sonoma County in California.

Edouard Duval, CEO of Shanghai importer East Meets West, told the global group of wine professionals that while there's less "ganbei!" in China these days thanks to a government crackdown on extravagance and gift-giving, the number of Chinese who drink wine at least weekly is up 35 percent.

"These are people who drink to enjoy, not to impress," he says.

Noting that average per capita consumption in the Chinese mainland is 1.2 liters annually, compared to 6 in Hong Kong and 10 in the United States, Duval says the potential of the Chinese market remains strong.

The drivers include continuing economic growth, an expanding middle class and explosive growth in travel, he says. "Travelers are people with purchasing power-they visit wineries, experience wine culture and bring it home with them."

About the surge in online purchasing in China, Duval says it has lowered the sale price of wines but has boosted the number of imported wines available in China, a net plus.

Marc Soccio of California-based Rabobank notes that while the market has gone up, down and now up again, the slowdown in wine sales since 2012 has affected Chinese producers most: Imports-particularly from Australia, Spain and Chile, are up. While Chinese wineries have made some great strides in quality, he predicts it will take 10 years for them to significantly affect import sales.

Several speakers critiqued the notion that millennials are reshaping the wine market. Rob McMillan of Silicon Valley Bank notes that while today's young people may shift from beer to wine more quickly than their parents, they have limited spending power and globally reach their peak earning potential later in life thanks to the 2008 recession.

Noting what he calls "an irresistible rise in premium brands", McMillan says the 35-55 demographic continues to be the driver of the most profitable segments of the industry.