HSBC revises up its mainland GDP forecast

Updated: 2010-03-20 06:58

By Li Tao(HK Edition)

|

|||||||||

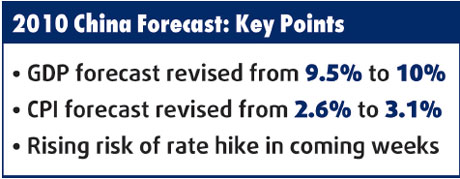

With a faster-than-expected export-sector recovery and growing momentum in industrial production in Hong Kong, HSBC has increased both the mainland's economic growth and inflation forecast, and has predicted a rising risk of a rate hike in the coming weeks.

In an HSBC Global Research commentary released Friday, the bank revised the mainland's 2010 gross domestic product (GDP) forecast to 10 percent from the previous 9.5 percent. The consumer price index (CPI), the main gauge of inflation, was also adjusted to forecast an increase to 3.1 percent, 0.5 percent higher than previously predicted.

"China's economic growth has been accelerating so far this year and most of the latest data releases beat expectations. Growth in industrial production surged to 20.7 percent and exports jumped 31.5 percent, while imports grew by 63.6 percent year-on-year in January-February," said Qu Hongbin, chief economist with HSBC China.

Although uncertainty about the strength of the global demand recovery remains, especially in the second half of this year, Qu said given the strong exports recovery momentum in the last three months, HSBC has raised the full-year exports growth forecasts to 25 percent for 2010 and 20 percent for 2011, versus the 9 percent and 10 percent previously predicted.

The imports growth projection has also been revised upward, to 32 percent for this year and 22 percent for next year. China's strong domestic demand, underpinned by continued investment in ongoing infrastructure projects and improving labor markets and consumer sentiment, is also expected to support growth of imports of finished products.

Qu said stronger exports should directly lift industrial output and create more new jobs, supporting a quicker recovery of wages and indirectly boosting consumer spending. There are even some factories faced with the difficulty of hiring workers to meet rising export orders in the coastal exports bases, which has prompted offers of higher wages to attract qualified workers.

"These new developments point to improving labor market conditions and, hence, to robust consumer spending in the coming quarters. All this implies that industrial production should also expand faster than we initially expected," Qu said.

"We expect growth to peak at 11.5 percent year-on-year in the first quarter before gradually softening in the second half in 2010 amid the fading lower base effect and the impact of policy tightening," Qu added.

Qu said strong growth has also been lifting inflation, with the headline CPI hitting 2.7 percent year-on-year in February, its highest pace in 16 months. He said the rising risk of overheating growth is likely to spur some immediate steps toward policy tightening.

"We continue to expect further acceleration in the headline CPI until around mid-year, with year-on-year spikes of around 4 percent likely. Stronger exports imply larger aggregate demand and better capacity utilization, translating into tighter demand and higher inflation pressure."

Qu said given that inflation is Premier Wen Jiabao's top concern, the central government is likely to further tighten policy to cool inflation, and continue to unwind its stimulus measures, to contain overheating and inflation risk.

"On the monetary policy front, we believe that the stronger-than-expected growth and still excessive loan growth implies a rising risk of an earlier rate hike, though our main scenario of a 54 basis points total rate hike starting in the second quarter this year remains unchanged. We stick to our view that quantitative tightening this year will be primarily conducted through another 150-200 basis points of reserve ratio hikes and lending curbs," said Qu.

China Daily

(HK Edition 03/20/2010 page2)