March home-sale registrations surge 53% yr-on-yr

Updated: 2010-04-08 07:37

By George Ng(HK Edition)

|

|||||||||

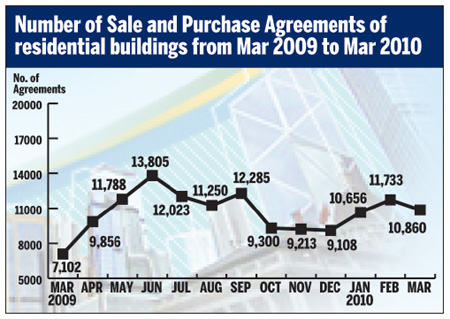

Government figures released Wednesday showed that residential property sales surged 52.9 percent in March from a year ago, as more and more home buyers scrambled to take advantage of the historically-low mortgage rates.

Residential transactions lodged for registration totaled 10,860 last month, up from 7,102 in the same month of last year, figures from the Land Registry showed.

In value terms, home sales for March rose 90 percent to HK$48.4 billion from HK$25.45 billion a year ago.

Month-on-month, home sales declined 7.4 percent in volume terms but rose 18.6 percent in value terms. The discrepancy between sales in volume terms and sales in value terms can be explained by the fact that large units accounted for a higher percentage in March than in the previous month.

The March figures actually relate to transactions in February, as there is usually a four-week time lag between closing a transaction and the lodging for registration with the Land Registry.

The high liquidity in the banking system, a direct result of the ultra-easy monetary policy implemented by governments worldwide after the financial tsunami, has driven banks into bitter competition for mortgages in recent months, a form of business that is considered lucrative and safer than other types of lending.

Some major lenders in the city are currently offering home buyers mortgage rates lower than 1 percent, a historically low level.

The historically-low interest rates, coupled with the high liquidity, have helped push residential prices up another 6 percent over the first quarter of this year after a 27 percent jump last year, Buggle Lau, chief analyst at Midland Realty, told China Daily.

Lau is bullish about the outlook for the property market for at least the next quarter, citing that the favorable fundamentals remain unchanged.

"Interest rates remain at historically-low levels; home supply will be unlikely to surge in the near term; improvement in the unemployment situation and recovery in the economy continues; and inflation expectation is rising," the analyst said.

"All these factors bode well for the property market for the next several months," he said.

Lau expects property prices to rise further by a single-digit percentage in the second quarter, with sales volume remaining robust.

Patrick Chow, head of Research at Ricacorp Properties Ltd, echoes Lau's optimism, citing similar reasons as well as the positive wealth effect created by the rally in stock market.

"The boom in the property market will likely continue at least in next several months," he said.

He forecasts a 5-6 percent price rise in the mass residential market and a 10 percent gain in the luxury residential market.

(HK Edition 04/08/2010 page2)