China Merchants first-half net profit rises 12%

Updated: 2010-08-31 08:00

By Li Tao(HK Edition)

|

|||||||||

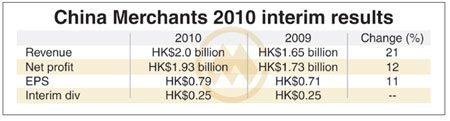

China Merchants Holdings (International) Co, one of the major container port operators in the country, reported a 12 percent rise in net profit from the first half. Aided by export resurgence from the impact of global economic crisis, its net profit climbed to HK$1.93 billion or HK$0.79 a share for the six months ending June, up from HK$1.73 billion, or HK$0.71 a share, a year ago.

Revenue rose 21 percent to HK$2 billion. The company has proposed an interim dividend of HK$0.25, same as a year earlier.

The blue-chip company, a unit of the mainland conglomerate China Merchants Group, said the throughput of its major ports are climbing close to, or even surpassing the level achieved in late 2008 when economic downturn struck across the globe.

"Our container throughput grew 22.5 percent year-on-year, very near that achieved in the same period in 2008, when the bulk and general cargo throughput rose 25.3 percent year-on-year which was a historical peak," Managing Director Hu Jianhua told a media briefing on Monday.

The company is the largest container terminal operator in terms of volume of cargo in Shenzhen, which operates at nearly all the terminals in the western part of Shenzhen's port, the mainland's second-largest port after Shanghai.

"Business in some ports like Qingdao and Zhangzhou was robust in the first half this year. But fee rates in these ports were comparatively low. That explains why the company's overall freight handling capacity grew faster than the profit it earned in the first six months," said Deputy General Manager Cynthia Wong.

The upside room for rate hikes for domestic handling charges is ample, said Hu. "The current roll rates were fixed 7 years ago. It's cheaper," he added.

However, Hu expects the growth in the mainland's container throughput to slow down in the second half due to the impact of the European debt crisis as well as a higher comparable base.

The effects of the debt crisis on the economy, the higher comparable base and the weak growth momentum of the global economy altogether will result in the mainland economy showing a steady growth, he added.

Hu said the company is proactively seeking domestic and overseas investment opportunities.

"Demand from emerging markets could be the next growth engine, such as intra-regional trades between China and Southeast Asian countries," said Hu, noting that the company is also seeking collaborative activities in Africa.

China Daily

(HK Edition 08/31/2010 page3)