Flurry of IPOs highlights ample liquidity

Updated: 2010-09-14 08:35

By Oswald Chen(HK Edition)

|

|||||||||

|

A trader monitors stock transactions at Hong Kong Exchanges and Clearing Ltd's trading floor earlier this year. A number of mainland companies are to launch their initial public offerings (IPO) in Hong Kong this week. A total of approximately HK$9 billion is expected to be raised, showing ample liquidity in the market. Jerome Favre / Bloomberg |

Seven firms to raise HK$9b this month

Seven mainland companies are to launch their initial public offerings (IPO) activities in Hong Kong this week, raising a total of approximately HK$9 billion.

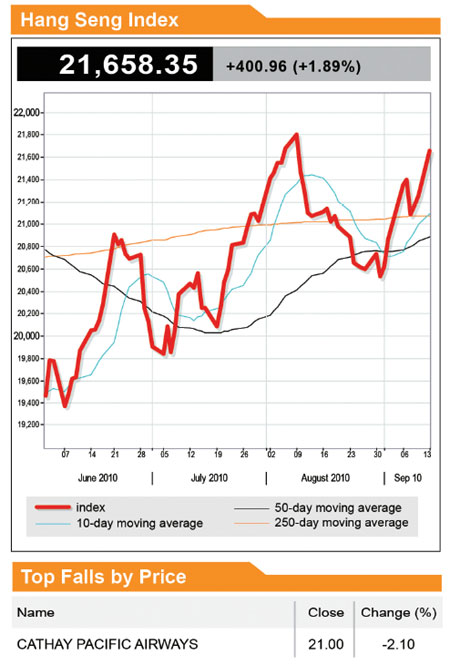

The flurry of activity is a sure sign that there is ample liquidity in the market. And with the recent rebound in the local stock market, equity analysts are arguing that even more companies are set to take advantage of the recent IPO mania.

As these IPOs are relatively small and more capital is flowing into the domestic financial system along with interest from institutional investors, liquidity in the market will be able to support it, said Kenny Tang, Head of Research and Executive Director of Redford Asset Management.

"As the local stock market has had a recent correction, there is no further downside risk after this wave of IPOs as the market has reached an attractive price-to-earnings ratio of 13 times", Tang told China Daily.

Asked whether American International Assurance's (AIA) proposed Hong Kong IPO scheduled for October or November will exhaust local liquidity, Tang said it is difficult to gauge at the moment. But it will be dependent on the actual fund flow in the local financial system.

Tang is choosing consumption-related IPOs as his top pick as they are supported by the Central Government's policy of transforming the economy from being primarily based on exports and fixed-asset investment into a consumption-led one.

China Daily

(HK Edition 09/14/2010 page3)