Citibank: 60% potential home buyers say ownership out of reach

Updated: 2010-10-08 09:04

By Emma An(HK Edition)

|

|||||||||

|

A luxury high-rise apartment stands in Hong Kong. Citibank research said about 60 percent of potential home buyers are not confident about buying property in short term. Jerome Favre / Bloomberg News |

Prices hiking, 'sweet home'less attainable

Around 60 percent of potential home buyers express little confidence that they will be able to purchase property in the near future, according to a research released by Citibank Thursday. And nearly half of them also expect property prices to continue to rise in the next two years.

Of the 1,063 respondents aged over 18, around 60 percent said that they have "no hope" of purchasing a house in the next 10 years if prices remain at the current levels, the research says. Comparatively, only one fifth of potential buyers are confident that they will be able to acquire a home within the next five years.

"It is evident that people in the city hold little confidence about owning a home in the short term," said Lawrence Lam, director of consumer lending at Citibank.

Home prices have jumped more than 48 percent since the beginning of 2009, helped by record low mortgage rates as well as an influx of mainland buyers. According to the latest figures released by the government, the average price of a residential flat with a gross floor area of 40 to 70 square meters was HK$85,502 per square meter on Hong Kong Island in August, while those in Kowloon were sold at HK$70,093 per square meter.

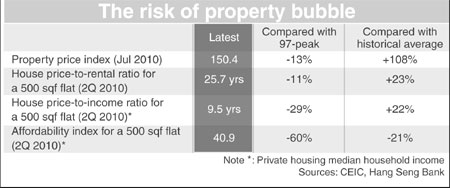

Home prices are nearly on a par with peak 1997 levels, the year the property bubble burst.

"Local property prices are overvalued by a large margin, although housing, in terms of monthly mortgage payments, appears to be affordable due to an extraordinarily low interest rate environment," Irina Fan and Joanne Yim, two economists at Hang Seng Bank, said in the bank's latest economic outlook report.

Sharing the city-wide concern that housing is becoming unaffordable, the government has recently rolled out intervention measures hoping to cool the market, including a pledge to boost land supply and raising down-payment ratios to curb demand.

However, the measures have yet to have much effect, prompting many of those aspiring to own a home to press for some kind of government subsidy or assistance.

According to Citibank's research, 42 percent of respondents believe that the government is obligated to help them own a house, compared with 37 percent who think that parents should shoulder more of the responsibility to help their children buy one.

According to the research, around 41 percent of property owners bought their first home at the age of 26 to 30. For first-time home buyers, most of them are looking at a 500-to-700 square feet flat valued at HK$1.9 million to HK$2 million. However, the maximum they feel comfortable to pay for the mortgage is 20-30 percent of household income, the research says.

China Daily

(HK Edition 10/08/2010 page)