Stocks fall on China rate rise

Updated: 2010-10-21 07:05

(HK Edition)

|

|||||||||

Hong Kong stocks fell after China unexpectedly increased its lending and deposit rates, raising concern a slowdown in the world's fastest-growing major economy may derail the global recovery.

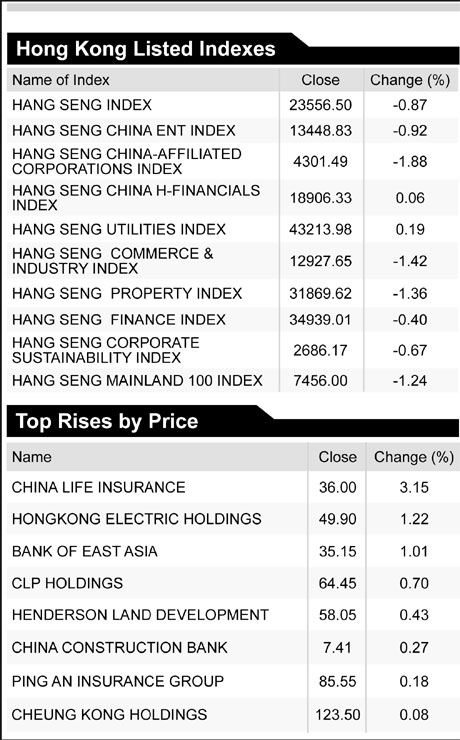

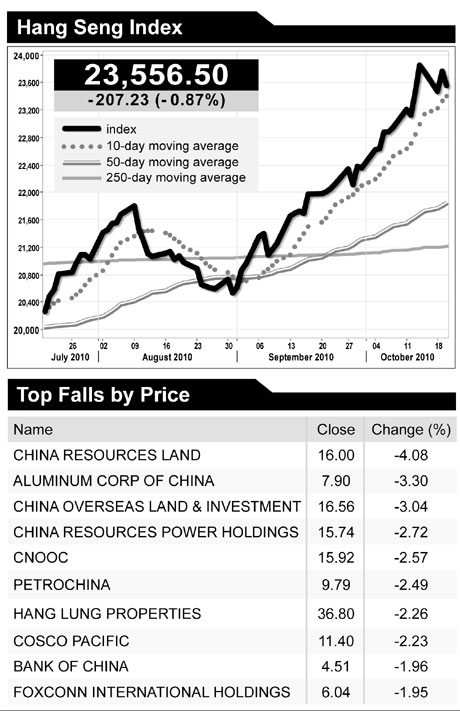

The Hang Seng Index (HSI) declined 0.9 percent to 23,556.50 at the close, with more than nine stocks declining for every two that advanced on the 45-member gauge. The measure had advanced 6.3 percent this month through Wednesday. The Hang Seng China Enterprises Index slid 0.9 percent to 13,448.83.

"It's a good excuse for the market to have a correction," said Alex Au, managing director of Richland Capital Management Ltd in Hong Kong. "But if the market corrects to a certain level, there will be a lot of money on the sideline to put on more risk."

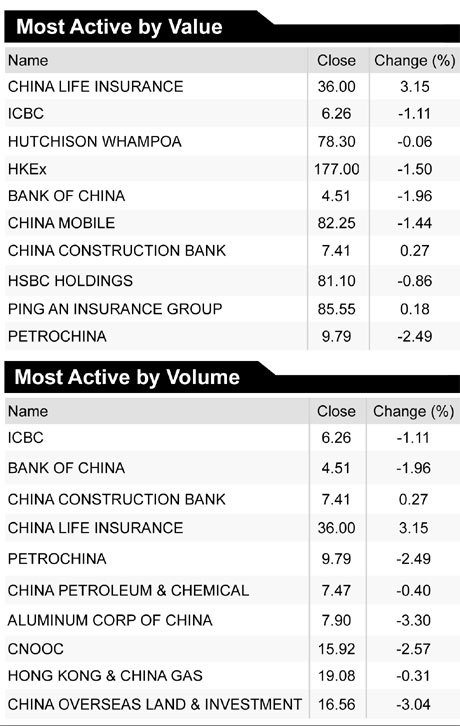

China-based developers and banks fell. Guangzhou R&F Properties sank 5.3 percent to HK$11.52. China Resources Land tumbled 4.1 percent to HK$16. China Overseas Land & Investment Ltd dropped 3 percent to HK$16.56. ShimaoProperty Holdings Ltd dropped 5.8 percent to HK$12.90.

Industrial & Commercial Bank of China Ltd fell 1.1 percent to HK$6.26. Bank of China Ltd slid 2 percent to HK$4.51.

China's central bank raised borrowing costs Tuesday for the first time since 2007, as policy makers try to curb lending and prevent an asset-price bubble. China lifted the benchmark one-year lending rate to 5.56 percent from 5.31 percent. The deposit rate was increased to 2.5 percent from 2.25 percent.

Thirteen of the 19 economists surveyed by Bloomberg News last month forecast that lending rates would stay unchanged this year. Central bank Governor Zhou Xiaochuan signaled October 8 that bank reserve requirements and bill sales were sufficient tools to control inflation.

Futures on the HSI declined 1.1 percent to 23,554.

Bloomberg

(HK Edition 10/21/2010 page3)