China Eximbank to issue 5b yuan 3-year bonds

Updated: 2010-11-09 06:50

By Emma An(HK Edition)

|

|||||||||

The Export-Import Bank of China said Monday it plans to sell as much as 5 billion yuan of three-year yuan-denominated bonds in Hong Kong at a yield of 2.65 percent.

This was the third time the bank has issued yuan-denominated bonds in the city, having done so previously in 2007 and 2008.

"This is China Eximbank's third renminbi bonds offering in Hong Kong," said China Eximbank Chairman Li Ruogu at the launch. "We hope that by issuing the bonds, we can contribute to the development of the Hong Kong market by providing a quality renminbi debt securities investment product, widening the market's investment choices and build a broader connection with Hong Kong financial institutions for further cooperation and development."

This latest bond sale in the city came three weeks after China Development Bank issued 3 billion yuan worth of three-year yuan-denominated bonds at an interest rate of 2.7 percent.

Despite the lower interest rate compared with that offered by China Development Bank, China Eximbank is nevertheless very likely to find that their bonds will be in hot demand, said Stephen Chang, head of fixed income, Pacific region, at J.P. Morgan Asset Management.

The yuan-related business is becoming popular in the city, particularly after the Central Government approved the use of the yuan for cross-border trade settlement and made the internationalization of the currency a top policy priority. The signing on July 19 between the mainland and Hong Kong of the revised clearing agreement for the renminbi gave a strong boost to the city's yuan-related business.

By the end of September, Hong Kong's yuan deposits had totalled 149.3 billion yuan, up 14.5 percent from August.

"We see a strong demand for renminbi-related products (in Hong Kong)," said Gina Tang, head of debt capital markets of Hong Kong & China at HSBC. She added that the trend will continue as the yuan-related financial products will provide "a high-yield investment vehicle within a low-interest rate environment" for risk-adverse investors with a need for "asset diversity".

The 12 months up until September 2010 saw yuan deposits at HSBC grow by more than 80 percent year-on-year.

Since China Development Bank pioneered the first ever yuan-denominated bond sale in Hong Kong in 2007, seven domestic banks have so far sold a total of more than 50 billion yuan worth of yuan-denominated bonds (including the current issuance) in the Hong Kong market.

This year alone has seen financial institutions including the Bank of China, Asian Development Bank and China Development Bank sell yuan-denominated bonds in the city.

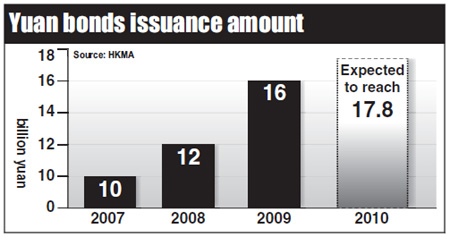

Norman Chan, chief executive of the Hong Kong Monetary Authority, predicted earlier this year that yuan-denominated bond sales in Hong Kong will likely amount to 17.8 billion yuan.

China Daily

(HK Edition 11/09/2010 page2)