Analysts: Moves to curb property speculators will work

Updated: 2010-11-20 07:39

By Li Tao(HK Edition)

|

|||||||||

Analysts said that the measures taken by the Hong Kong government to curb property speculators are likely to be effective in the short term.

The government imposed new measures Friday in a bid to cool the city's red-hot property market by imposing heavy stamp duties on some transactions and tightening mortgage restrictions.

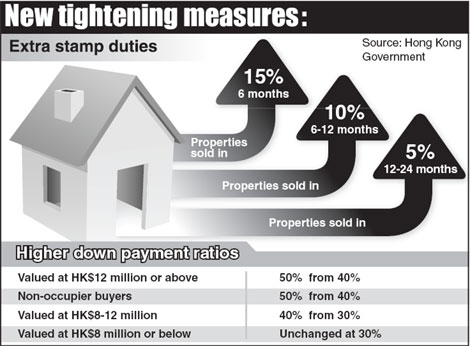

Financial Secretary John Tsang said that homes sold within six months of purchase starting today will be subject to a punitive stamp duty of 15 percent. Those resold within six to 12 months will have an extra stamp duty imposed on it of 10 percent, while those sold between 12 and 24 months will be charged 5 percent.

Meanwhile, Hong Kong Monetary Authority Chairman Norman Chan announced that down payments on homes costing more than HK$12 million will be increased to 50 percent from the previous 40 percent. Those costing between HK$8 million and HK$12 million will increase to 40 percent from 30 percent.

"The special stamp duty will immediately cool the market and investment activity will disappear completely for the short term," said Nomura International analyst Paul Louie.

He also said that the government's measures were "very significant" and "much harsher and punitive than the market had expected."

He said the tougher rules could result in a 40 percent drop in transaction volumes of private secondary apartments over the short term, and with speculators out of the picture, stabilize prices in the near term.

"Short-term speculators will no longer be able to make any money from the resale of properties since we can hardly expect home prices to rise by as much as 15 percent within six months," said Wong Leung-sing, associate director with Centaline Property Agency.

Wong added that imposing punitive stamp duties on speculators who flip properties within a short period of time is the first time such an approach has been taken in the city.

Chong Tai-leung, an economics professor at the Chinese University of Hong Kong, agreed that the new measures will help curb short-term speculative activities in an effective manner.

He said since most speculators resell their properties within two years, the extra stamp duty will very likely curb speculation in the short term.

"But there is also a chance that speculators will include the tax in the selling price by pushing up the asking price," said Leung.

Centaline's Wong agrees, saying that a further home price hike seems inevitable due to ample liquidity in the market and a short supply of homes.

He aslo said that the additional measure to raise down payments on residential properties may still miss the target.

"Hong Kong banned bank loans to tame home prices in 1997, but it was unable to stop those speculators who paid up in cash. Lifting the required down payment on a wider bracket of properties could hurt those really aspiring to buy homes," Wong added.

Donna Kwok, greater China economist at HSBC, said that the measures are likely to have a more long-term effect.

"This is the most creative and carefully crafted move from the Hong Kong authorities since 2009 for tinkering with demand-side factors in the property market, because the scope of motive has been widened," Kwok said. "As a result, this latest set of measures will likely have the biggest and most lasting impact that we've seen yet for cooling Hong Kong property prices."

Dow Jones contributed to this story.

China Daily

(HK Edition 11/20/2010 page2)