Underlying inflation hits 19-month high of 2.3%

Updated: 2010-11-23 07:22

By Li Tao(HK Edition)

|

|||||||||

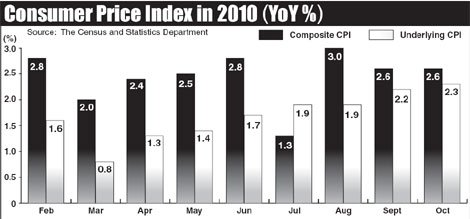

Hong Kong's underlying inflation rate inched up to 2.3 percent in October from 2.2 percent in the previous month, driven by higher rents and food prices. However, economists said the data failed to reflect the surge in rental prices in the city this year.

Figures released by the government Monday show that Hong Kong's overall consumer prices - a gauge of inflation - rose 2.6 percent year-on-year in October, unchanged from the previous month.

Netting out the effects of the government's one-off relief measures, including the electricity charge subsidy, the underlying price hike in October was 2.3 percent, slightly higher than that of 2.2 percent in September.

The accelerating inflation rate in October was mainly due to stiff increases in private housing rentals and food prices (excluding meals bought away from home) the Census and Statistics Department said on its website.

Food prices increased 5.7 percent last month as the cost of imports continued to climb, the government said.

Housing prices also rose 1.7 percent in October compared with the same period last year, but economists nevertheless forecast that the surge in rental prices this year will bring the greatest upside risk to the city's Consumer Price Index (CPI).

According to data released by real estate broker Centaline Property Agency, Hong Kong's private home rents rose 15 percent in October compared with a year earlier, much higher than the figures released by the government Monday.

"It is because rent prices were being established when people were preparing the rental lease, which could date back as long as two years ago," said Paul Tang, chief economist from the Bank of East Asia, adding that the rental surge this year will affect the inflation rate significantly in the next few months.

Backed by strong exports and consumption figures, the Hong Kong government this month raised its full-year GDP growth forecast to 6.5 percent from 5-6 percent after it reported a better-than-expected 6.8 percent rise in the third quarter.

It also lifted the full-year inflation forecast to 2.5 percent, which means "the fourth quarter CPI index will at least reach out to 3 percent," said Irina Fan, senior economist at Hang Seng Bank. She predicted that inflationary pressure next year will continue to mount.

"Inflation in Hong Kong is likely to go up further in the near term, along with the rise-back in domestic costs, as well as greater external cost pressures from the regional wide increase in inflation in Asia," a government spokesman said in the report.

The spokesman also expects that the city's sustained economic growth could partially offset the effect of the US Federal Reserve's new round of quantitative easing, which is helping to fuel the fire in the city's red-hot property market.

China Daily

(HK Edition 11/23/2010 page2)