Stocks rise; resources firms rally

Updated: 2010-12-14 07:35

(HK Edition)

|

|||||||||

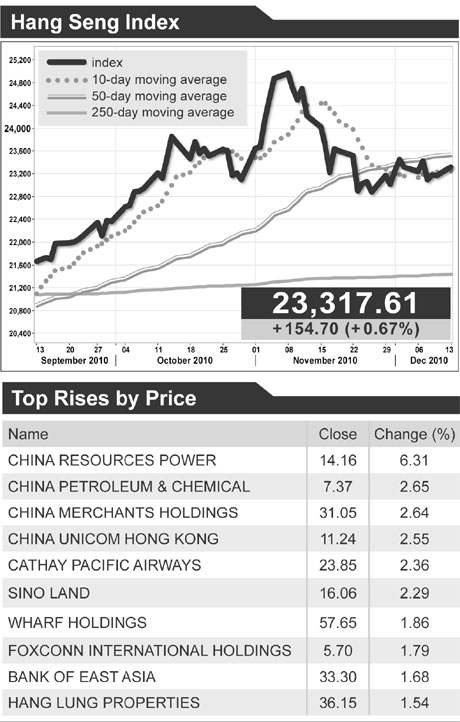

Hong Kong stocks rose for a second day in three as China refrained from raising interest rates and reports showed global economic growth gaining momentum.

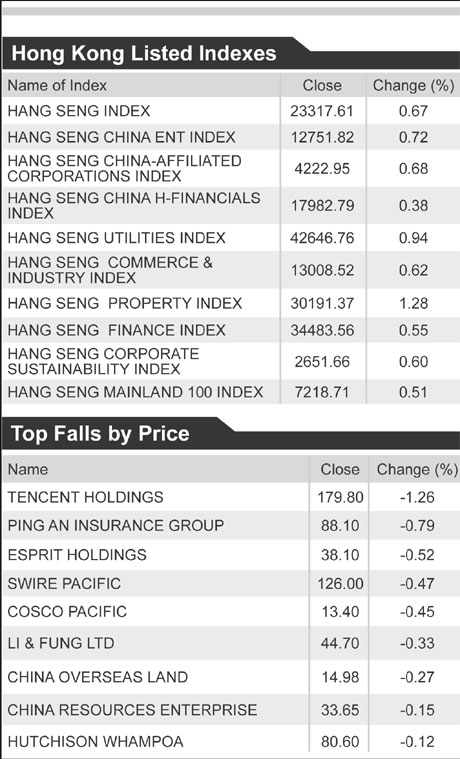

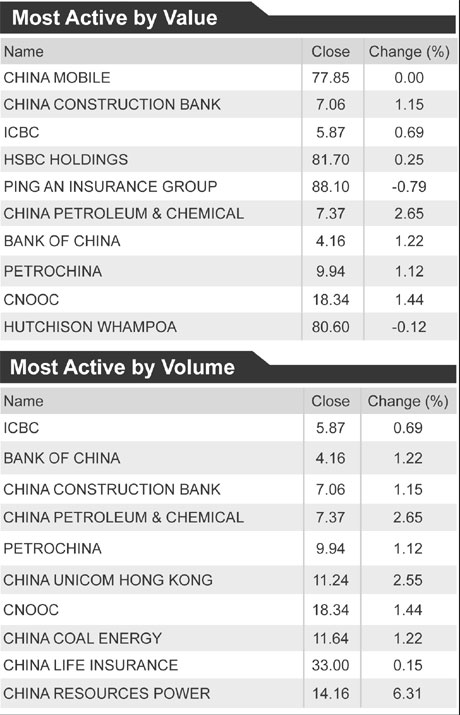

The Hang Seng Index (HSI) gained 0.7 percent to close at 23,317.61. China's consumer prices rose a more-than-forecast 5.1 percent from a year earlier, according to a December 11 statistics bureau report. The Hang Seng China Enterprises Index rose 0.7 percent to 12,751.82.

China Resources Power surged 6.3 percent to HK$14.16, the sharpest jump on the HSI. Anhui Conch Cement Co advanced 3.7 percent to HK$34.05, the biggest gain on the H-share index.

China's industrial-output gains accelerated to 13.3 percent last month from a year earlier, exceeding economists' median estimate, according to a December 11 government report. Consumer prices rose the most since July 2008.

Yue Yuen climbed 3.4 percent to HK$28.80. Techtronic Industries Co rose 3.1 percent to HK$9.90.

The Reuters/University of Michigan preliminary index of consumer sentiment rose to 74.2 from 71.6 at the end of November. Economists projected a December reading of 72.5, according a Bloomberg News survey.

Consumer expectations for six months from now, which more closely projects the direction of consumer spending, increased to a six-month high of 66.8 from 64.8, the December 10 confidence report showed.

Midland surged 6.8 percent to HK$6.16. Centaline Property Agency said it handled 53 home sales over the weekend, a 61 percent increase from the previous week.

The Hang Seng Property Index's 1.3 percent advance was the biggest among the four industry groups tracked by the HSI. Sun Hung Kai Properties Ltd climbed 1.5 percent to HK$131.70. Cheung Kong (Holdings) Ltd rose 1.4 percent to HK$115.90.

Almost four stocks gained for each that fell on the 45-member HSI. Futures on the gauge advanced 0.6 percent to 23,318.

The HSI has dropped 5.6 percent since a government report on November 11 showed China's inflation accelerated to 4.4 percent in October, sparking speculation the People's Bank of China will raise interest rates.

Bloomberg

(HK Edition 12/14/2010 page3)