When China catches a cold, the world sneezes

Updated: 2010-12-30 06:49

(HK Edition)

|

|||||||||

When I was young, the old investment rubric used to be that when the US caught a cold, the rest of the world came down with flu because the US is too big to fail.

Nowadays this important role has shifted from the US to China, where a piece of disappointing Chinese economic news can be significant enough to trigger a market correction. Why? And how does this shift change the investment ecosystem?

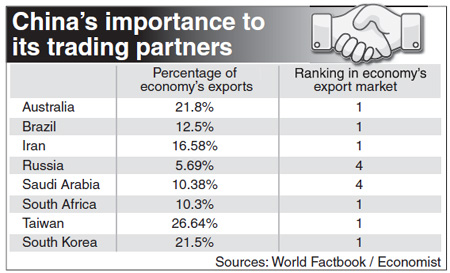

China is playing an important role as a commodities importer. For example, China takes 40 percent of global demand of copper for the use in the electronics and construction industries, and 46 percent of coal consumption. Referring to the table, China is playing a very important - some would say dominant - role in relation to the leading natural resources exporters. To some of its immediate neighbors, such as Taiwan and South Korea, exports to the mainland accounted for more than 14 percent and 10 percent of their GDP respectively. Therefore, we should not be surprised when there is any unexpected news that lead investors to posit that the "growth engine" has come to an end and causes market jitters.

We have found that some important trading partners, such as Australia and South Korea, are positively correlated to China PMI - in fact they are even more sensitive than domestic A-share markets. Moreover, not only does this situation occur in their equity markets, but it can also be applied to the currency market. Compared with the Canadian dollar, the Australian dollar has traditionally moved closer to China and other emerging markets as Australia is their major commodity supplier. The correlation has become even stronger since the global financial crisis of 2008 - it is almost 0.8.

With the growth of China starting to slow down and more tightening concerns looming on the horizon, the story for emerging markets is going to turn to a new page in 2011. The Economist forecasts China's growth rate will moderate to 8.9 percent next year. This is clearly lower than the 10-year annual average of 9.73 percent, and markets that are heavily reliant on China's economy may lose some steam next year, especially for those markets which have already registered outstanding performance this year, eg South Korea and South Africa.

However, this does not imply we are pessimistic on China equities. First of all, a more aggressive tightening policy or rate cycle on the mainland is unlikely to happen since core CPI figures depict tame inflationary pressure - thus fears of a hard economic landing are indeed overstated. Moreover, plans for welfare housing and the nurturance of seven emerging industries, ie new energy, environmental protection etc, will ensure a government spending spree.

Finally, the humble performances in both Hong Kong and mainland markets in 2010 are not a reflection of their real strength. Subject to market jitters amid tightening policies, those benchmark indices were the laggards among their counterparts this year; in addition to relatively cheap valuation*, the upside story for China is still valid in 2011.

* The latest Morgan Stanley report forecasts that MSCI China will trade at a P/E multiple of 12.2x in 2011 which is lower than its 10-year historical average of 13.8x.

The author is a research manager at Alroy Financial Services Ltd, an independent financial services provider. The opinions expressed here are entirely his own.

(HK Edition 12/30/2010 page3)