Gaming stocks shine on strong revenue growth

Updated: 2011-01-04 07:23

By Joy Li(HK Edition)

|

|||||||||

Hong Kong-listed Macao casino operators shone brightly in the first trading day of 2011, as investors took heart from statistics showing that gaming revenue in the world's largest gambling market jumped 58 percent in 2010 with further growth expected in 2011.

Galaxy Entertainment Group rose 5.6 percent to HK$9.29 and Wynn Macau saw their shares close up 5.8 percent Monday at HK$18.40. SJM Holdings, controlled by billionaire Stanley Ho, ended trading at HK$12.76, up 3.4 percent, while Sands China finished 1.6 percent higher at HK$17.36.

The benchmark Hang Seng Index closed at 23,436, up 1.74 percent or 400 points.

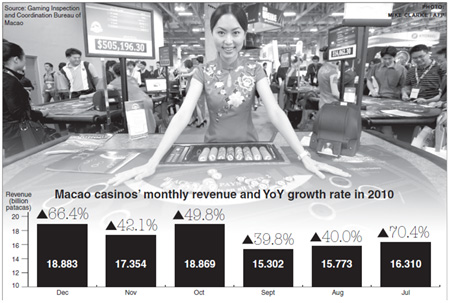

According to figures released by the Macao government Monday, casino revenue in the city soared 58 percent in 2010 to 188.343 billion patacas ($23.51 billion). Revenue in December alone jumped 66.4 percent to 18.883 billion patacas, exceeding October's 18.869 billion patacas and registering a monthly record high.

Analysts remain generally bullish about the prospects for the gaming sector in the coming year.

CLSA, a brokerage house, said in a report that while its growth rate is slowing given higher base comparisons going forward, momentum in terms of absolute gaming revenues is still strong in Macao. The investment house estimated that due to more mainland visitors and improving economic conditions, gaming revenue in Macao, the only place in China where gambling is legal, will increase 20 percent and 25 percent, respectively, in the next two years.

Figures from Macao's statistics bureau showed that total visitors reached 22,694,110 in the first 11 months of 2010, up by 15.1 percent year-on-year. The majority of visitors were from the mainland, accounting for 53 percent of the total, followed by Hong Kong (30 percent) and Taiwan (5 percent). In November, visitors from the mainland increased by 7.9 percent year-on-year to 1,096,865 (54.5 percent of total), with 40 percent of them traveling to Macao under the Individual Visit Scheme, up 13.5 percent from a year ago. The scheme allows visitors to travel without joining a tour group.

Analysts at UBS Investment Research, another securities research house, wrote in a research note that based on the fourth quarter monthly revenue run rate, their recently revised 2011 revenue forecast already looks conservative. The bank's last prediction for 2011 was 221 billion patacas, or 18 percent higher than the final 2010 figures released Monday.

As for individual companies, Wynn Macau is an eye-catching player, according to UBS. It commented that despite an apparent increase in competitive intensity in the VIP market, Wynn Macau has easily withstood the impact of a vastly improved MGM hotel. The bank estimated MGM gaming revenues up 60 percent sequentially.

Sands China, with three casino properties, held the dominant position in the mass market for the first nine months of 2010, said UBS. After completing its phase-five and phase-six projects, Sands China will become Macao's largest operator, according to CLSA.

China Daily

(HK Edition 01/04/2011 page3)