Strong corporate earnings will back stock valuations: Analysts

Updated: 2011-01-08 07:15

By Joy Li(HK Edition)

|

|||||||||

|

Standard & Poor's believes that equity markets in Hong Kong and on the mainland are now "cheap enough", while Daiwa Capital Markets believes that 2011 will see strong growth for both bourses. Mike Clarke / AFP |

Standard & Poor's, Daiwa forecast 15-20% EPS growth in 2011

A sanguine outlook for company earnings is lending support to attractive valuations in both the Hong Kong and mainland equity markets, analysts from Standard & Poor's and Daiwa said Friday.

Both research houses have forecast growth in the range of 15 to 20 percent in earnings per share in 2011.

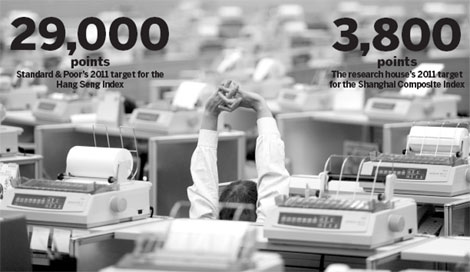

Standard & Poor's, the global ratings agency, believes that the equity markets in Hong Kong and on the mainland are "cheap enough". The agency's equity research arm has set its 2011 target for the Hang Seng Index at 29,000 points, representing potential upside of 22.4 percent from the Friday close of 23,686.63 points. For the Shanghai Composite Index, the research house's 2011 target is 3,800, or a potential upside of 33.8 percent from the Friday close of 2,838.80 points.

Meanwhile, Daiwa Capital Markets, the investment banking arm of Daiwa Securities Group, believes that 2011 will be a year of strong growth for the local and mainland bourses.

"With economic and corporate earnings growth rates likely to remain robust and the Chinese market trading at a discount to the MSCI Asia ex Japan average, we expect the market to outperform this year," said Colin Bradbury, regional chief strategist, Asia (ex-Japan) at Daiwa.

Standard & Poor's identified inflation concerns and the prospect of interest rate hikes as the major risks for equity markets in the greater China region, however.

Mingchun Sun, greater China chief economist at Daiwa, expects CPI to peak in January this year and fall sharply thereafter, on the basis of seasonal inflation during the Spring Festival and the upside risk of bad weather brought by the effects of La Nina.

But Sun added that investor concerns regarding inflation and more aggressive policy tightening should fade as early as March.

Both houses are overweight the banking sector in 2011.

Standard & Poor's noted that the economic environment on the mainland is increasingly challenging, with rising interest rates and questionable asset quality. Nevertheless, it said that Hong Kong-listed mainland banks should weather the storm comfortably. Economic momentum will continue providing impetus to loan growth and the capital-raising exercises of state-owned banks. It should place them on a stronger footing in the future, S&P noted.

For the property sector, analysts at Daiwa believe that current valuations in the sector are attractive for long-term investors as policy risks have been fully factored in, thus deserving a positive rating.

Daiwa expects developers with greater exposure to non-residential assets, a capacity for growth and low financial leverage, to outperform their competitors. Hong Kong-listed China Overseas Land & Investment was cited as one such example.

For Hong Kong developers, the outlook remains challenging in the near- to mid-term and property share prices are likely to move in line with the market at best, according to Standard & Poor's. Tam Ching Wah, S&P's Hong Kong property analyst, thinks that recent government measures are likely to be severe enough to generate a 10 percent drop in Hong Kong property prices and a 25 percent decline in transactions.

China Daily

(HK Edition 01/08/2011 page3)