2011 inflation may hit 5%: Hang Seng

Updated: 2011-01-15 07:48

By Emma An(HK Edition)

|

|||||||||

Bank says increase could mean further home tightening measures

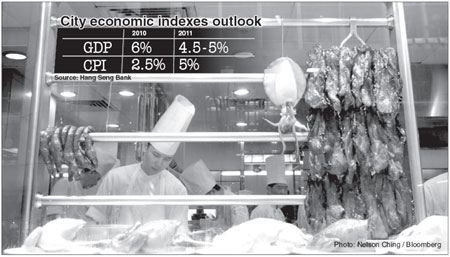

Inflationary pressure in the city is likely to worsen significantly this year with headline CPI jumping to 5 percent, Hang Seng Bank warned Friday.

The increase from last year's inflation rate of 2.5 percent is also likely to prompt further tightening measures in the property market, the bank said.

The uptrend is in part due to mounting inflationary pressures on the mainland given the close economic ties between the two, according to Wendy Yuen, head of the investment advisory investment services division at Hang Seng Bank.

The city imports a big chunk of its food items from the mainland.

Inflation has increasingly become a watchword across China, with the CPI figures continuing to surprise the market on the upside. At 5.1 percent in November, CPI on the mainland hit its highest level in 28 months.

"As the food prices trend up, we expect inflation to pick up further in 2011, particularly during the first half," Yuen said Friday while briefing the media on the investment outlook for 2011.

She expected inflation on the mainland to hover around 4-5 percent in 2011 on estimated GDP growth of 8-9 percent.

But the impact of inflation on the mainland will also be felt in Hong Kong.

As on the mainland, rents and food prices are poised to edge higher in Hong Kong, Yuen said.

"We expect to see higher rents and food prices in 2011, which may push the city's CPI up to a level of 5 percent," said Yuen. Food prices and rents currently account for 27 percent and 29 percent of Hong Kong's CPI respectively.

Still, curbing inflation will be difficult, reckoned Yuen, and may prod the government into launching more measures to cool down the housing market amid hot money inflows and yuan appreciation.

Soaring housing prices will ultimately lead to higher housing rents as well.

The Heng Seng Bank analyst projected 4.5-5 percent GDP growth for Hong Kong in 2011, buoyed by the booming mainland economy.

HSBC is also concerned about the city's inflation. In a report released Friday on the economic outlook for 2011, the bank suggests that Hong Kong's inflation will average at 4 percent during the first quarter and then start its upward march till the end of 2011. The average inflation rate is estimated at 4.9 percent for the fourth quarter of 2011.

Factors such as asset-price jumps, hot money inflows, US dollar weakness, low interest rates and climbing food prices will all send the city's inflation higher, HSBC economist Donna Kowk said in the report.

And inflation is a problem the government currently faces and still "can't side-step", she said.

Hong Kong Chief Executive Donald Tsang called checking inflation "the government's imminent task" as he attended his first question-and-answer session of 2011 at the Legislative Council Thursday. He said the government will unveil various measures "to alleviate the impacts of inflation on the people" if necessary.

China Daily

(HK Edition 01/15/2011 page2)