Mainland's food price inflation a permanent feature

Updated: 2011-01-19 07:18

(HK Edition)

|

|||||||||

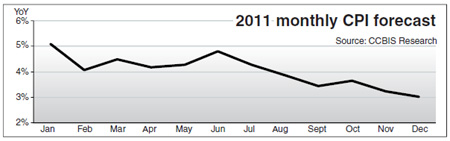

China's creeping CPI inflation will continue to be a major concern in the market in the first half of 2011.

The headline CPI is expected to remain stubbornly high at 4.5 percent year-on-year (YoY) in the first half of this year, primarily due to the carryover effect (base effect) accounting for two-thirds of the recent CPI hike, with the remaining third due to a new price driving force, ie, actual price increases - items which are gaining momentum on a month-on-month (MoM) basis.

The CPI is expected to trend downward in 2011, however, posting a 4.5 percent reading in the first half and a 3.6 percent reading in the second half. Excluding the impact of the carryover effect, the new price driving force will remain strong.

An examination and analysis of the country's CPI movements over the past four years has led to the following summarization:

Recent CPI inflation has been mainly a function of rising food prices. By setting the comparable base at 100 for December 2006, the nation's CPI increased by 14.9 percent over the past four years (4.5 percent YoY in December, 2010, according to CCBI's forecast). This was largely driven by a 40.8 percent hike in food CPI over the same period. Non-food CPI has remained fairly stable, rising only by 3.2 percent over the past four years.

Food price inflation has been driven by both increasing demand and falling production. CCBI's analysis reveals that food price inflation has been positively correlated with average disposable income growth and industrial output growth but negatively correlated with grain production.

Given the physical constraint on land resources and planting, the country's food price inflation is expected to become a permanent fixture of the economic landscape.

PPI (producer price index) hikes have largely outstripped non-food CPI hikes in the past four years. Again, using the comparable base of 100 for December 2006, the analysis finds that the country's PPI has increased by a total of 14.3 percent (versus non-food CPI increasing by 3.2 percent) in the past four years, implying that (1) productivity improvements have partly digested cost inflation in many manufacturing sectors; (2) some manufacturing sectors have little ability to pass cost inflation on to consumers; (3) service prices have remained quite stable.

Monetary policy will target long-term price stability over short-term movements in CPI. The analysis indicates the nation's policymakers have begun to factor core CPI (non-food and deducting energy prices) movements into their inflation assessments. The policymakers will likely adopt more administrative price controls while improving agricultural productivity in an effort to curb food price inflation.

The author is an associate director and economist at CCB International Securities Ltd. The opinions expressed here are entirely his own.

(HK Edition 01/19/2011 page2)