Investors bullish on equity market

Updated: 2011-01-20 06:56

By Joy Li(HK Edition)

|

|||||||||

Hong Kong investors are more confident about the prospects for the economy and investment market in the next six months, with 92 percent of respondents favoring stocks as their prime investment, according to a quarterly survey by JP Morgan Asset Management.

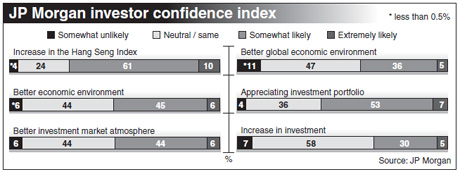

The latest findings show that the confidence of Hong Kong investors has risen further from the last survey taken in September, with the index increasing from 124 to 126. A score of 100 represents a neutral level.

"It suggested a further stabilization of investment sentiment for the next six months. In particular, the increase is supported by a stronger belief in the appreciation of the investment portfolio's value," said Eddy Wong, head of intermediary distribution at JP Morgan Asset Management.

A breakdown of the index shows that more investors expect an increase in income (up 11 points to 117) and better employment opportunities (up 9 points to 118).

Some 49 percent of respondents think that the Hong Kong economy has become stable, but they also believe that the outlook is unclear and that the economy has yet to enter a period of real and sustainable recovery. Asked about the biggest risk in Hong Kong in 2011, the bursting of the property bubble (34 percent) and inflation (30 percent) topped the list.

As to the change in investment strategy, the latest findings showed that 92 percent of respondents identified stocks as their most favored investment products for the next six months, up from 80 percent in the September survey. Funds (44 percent), IPO subscriptions (33 percent), and foreign currencies (30 percent) trail stocks on the preference list. For the Hang Seng Index target, 48 percent of respondents expect the index to trade between 24,001 and 26,000 points during the first half of 2011.

The 18th quarterly survey was conducted in December of 2010 based on a total of 507 respondents with a minimum of HK$100,000 in liquid assets and five years of continuous investment experience.

The investor confidence index is designed to reflect local investor sentiment towards the Hong Kong market over the next six months.

China Daily

(HK Edition 01/20/2011 page2)