China Resources Cement to boost capacity 33% in 2011

Updated: 2011-03-08 07:04

By Emma An(HK Edition)

|

|||||||||

China Resources Cement Holdings Ltd, the largest cement producer by production capacity in southern China, said Monday its plans to expand its production capacity by around one third in 2011 in anticipation of higher selling prices and rising demand.

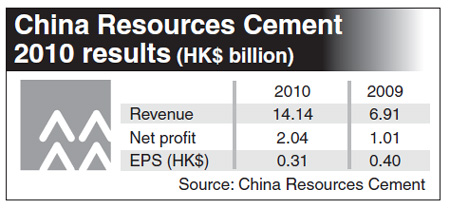

The company made the announcement the same day as it reported that its net profit more than doubled to HK$2.04 billion in 2010 as revenue soared to HK$14.14 billion from HK$6.91 billion in 2009, thanks to growth in both sales volume and selling prices. The company declared a final dividend of HK$0.045 per share for 2010. The company didn't pay a final dividend for 2009.

According to Zhou Longshan, chief executive officer at China Resources Cement, the company's production capacity will grow to 61.8 million metric tons by end-2011 and 77.8 million metric tons by end-2012 from 47.8 million metric tons currently.

The company sold 29.6 million metric tons of cement in 2010, up 80 percent from a year earlier, while its sales of clinker and concrete jumped 14 percent and 71 percent respectively in volume terms during the same period.

"The demand for cement products in China remained strong in 2010," Zhou Longshan said Monday at a media briefing.

Domestic cement production totaled 1.87 billion metric tons in 2010, 15.5 percent more compared with 2009.

The accelerated construction of property and large infrastructure products across China has fueled the demand for cement, the CEO said. To cope with growing demand, the company added 11 cement grinding lines in 2010, with eight more to be added in the next two years.

Zhou Junqing, the company's chairwoman, is bullish about the prospect for the cement industry going forward. For one thing, property construction will remain active despite central government measures to rein in the overheating property market, she suggested. Above all, "the construction of affordable houses, with 10 million such flats to be completed in 2011, will shore up demand for cement," she said.

The country's continuous investment in the areas of water conservation and related projects, highway and railways will remain another big source of demand, Zhou Junqing added.

Linus Yip, a strategist with First Shanghai Securities, is also optimistic about the company's outlook. "We are upbeat about the company's performance going forward," said Yip, citing the robust demand for cement due to property and infrastructure construction on the mainland.

A replication of 2010 profit growth in 2011 is definitely achievable, Yip added. The company's current gearing ratio of 61.6 percent, which rose substantially from 26.3 percent in 2009, is "acceptable for a company still in its expansionary phase", Yip noted.

China Resources Cement CEO Zhou Longshan sees a more than 5 percent increase in the average selling price (ASP) for cement in 2011, which leapt 23 percent to HK$336 per metric ton in 2010 on growing demand and a higher cost of coal.

On expectation of rising cement prices, investment bank UBS reiterated its "bullish view" on China's cement producers in a research note released Monday.

"With more disciplined supply, recovering demand and healthy inventory level, we believe the risks to cement prices are getting more and more on the upside," UBS analyst Mick Mi wrote in the note.

China Resources Cement currently has a market share of around 18 percent in southern China, which the company looks to grow to 25 percent through mergers and acquisitions-driven capacity growth, according to Zhou Junqing.

China Daily

(HK Edition 03/08/2011 page3)