Cathay Pacific orders 27 more planes

Updated: 2011-03-10 06:52

By Joy Li(HK Edition)

|

|||||||||

|

A Cathay Pacific Airways cargo jet taxis on a Chek Lap Kok Airport runway in Hong Kong. The company said the recent oil price hike due to the turmoil in the Middle East is a real concern. Jerome Favre / Bloomberg |

Airline ramps up despite oil price fears after reporting record high net profit

Cathay Pacific Airways Ltd said Wednesday it acquired 27 new planes in a multi-billion dollar deal to further boost its capacity after nearly tripling its annual net profit on the back of strong China cargo and passenger travel growth.

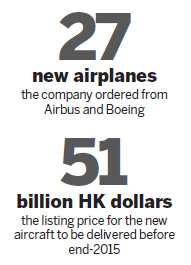

The Hong Kong-based airliner said it will buy 15 more Airbus A330-300s from Airbus SAS and 10 more Boeing 777-300 ERs from the Boeing Company. Besides these two agreements, Cathay will also add two more Airbus planes through a leasing deal. The aircraft will be delivered before the end of 2015. The listing price for the 27 new aircraft is HK$51 billion, the company said. The latest orders pushed up the carrier's new aircraft orders to a total of 91, valued at HK$185 billion and to be delivered between now and 2019.

"Our plan is to retire our 21 Boeing 747-400 and 11 Airbus A 340-300 aircraft before the end of the decade as we take delivery progressively of new generation aircraft that will provide much greater fuel and operating cost efficiencies. This is important both for environmental reasons and from a financial perspective as fuel remains our greatest single cost," said Cathay Pacific Chief Executive Tony Tyler, who is leaving to take up the chairmanship of the International Air Transport Association in July.

According to Cathay's Chief Operating Officer John Slosar, the new CEO taking the helm in April, cost per seat for the Boeing 777 model is 20-22 percent lower than the Boeing 747 model.

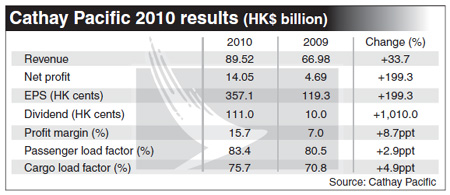

The largest carrier in Hong Kong also announced its full-year results on Wednesday, which posted record highs in terms of both profit and turnover.

Cathay recorded a net profit of HK$14 billion for 2010, up 199.3 percent from HK$4.69 billion in 2009. Turnover for the year rose by 33.7 percent to HK$89.52 billion. Last year's net profit included a HK$2.5 billion contribution from its stake in Air China Ltd, and a total of HK$2.2 billion in one-off gains from the disposal of stakes in a cargo handler and a plane-maintenance company.

Cathay Pacific and Dragonair carried a total of 26.8 million passengers in 2010, 9.1 percent higher than 2009. The passenger load factor, a measurement of utilized capacity to total available capacity, rose 2.9 percentage points to 83.4 percent. Passenger revenue for the year increased 29.3 percent to HK$59.35 billion.

Cargo freights, meanwhile, increased 18.1 percent to 1.8 million metric tons. Strong demand pushed up the cargo load factor by 4.9 percentage points to 75.7 percent. Cargo revenue increased by 50.1 percent to HK$25.9 billion.

Fuel is Cathay's largest single cost, representing 35.6 percent of total operating costs. Total fuel costs for 2010 increased by 40.4 percent.

"The recent spike in oil prices following instability in the Middle East is a real concern," said Cathay Pacific Chairman Christopher Pratt.

"If fuel remains at this level, or rises still further, we can expect an adverse effect on our profitability if the increased cost is not recovered through fuel surcharges or higher fares. Our business will also be quickly hurt if the increased price of oil leads to a reduction in global economic activity and a subsequent reduction in demand for air travel," said Pratt.

In the wake of the oil price risk, Cathay Pacific has hedged as much as 30 percent of its jet-fuel needs for the next one to three years, Chief Financial Officer James Hughes-Hallett said.

Standard Chartered, meanwhile, issued a special report on Wednesday arguing that oil will be traded in a range between $110 to $120 per barrel on strong demand and supply risks in the Middle East. Since September 2010, Brent crude oil prices have risen from around $75 per barrel to $112 per barrel.

Cathay's shares closed at HK$18.92 in Hong Kong trading Wednesday, up 4.42 percent. The benchmark Hang Seng Index closed at 23810, up 0.42 percent.

China Daily

(HK Edition 03/10/2011 page2)