China State Construction to raise HK$3.58b via rights issue to expand affordable homes biz

Updated: 2011-03-19 07:43

By Li Tao(HK Edition)

|

|||||||||

|

The China State Construction infrastructure project site at Choi Wan Road and Jordan Valley in Hong Kong. The company said on Friday that it plans to issue 597.4 million rights shares in the city. Provided to China Daily |

Hong Kong-listed China State Construction International Holdings Ltd (CSCI) plans to raise as much as HK$3.58 billion via a rights issue to expand its affordable housing business on the mainland.

It plans to issue 597.4 million rights shares on the basis of one rights share for every five existing shares at HK$6.0 each, the company told the Hong Kong Stock Exchange on Friday. The offered price represents a discount of 16.7 percent to Thursday's closing price of HK$7.20.

Shares of the company dropped 2.8 percent to close at HK$7.0 per share in Hong Kong trading Friday after the news was announced.

The rights issue is aimed at raising capital for the company's affordable housing business on the mainland this year, Zhou Yong, chief executive officer of CSCI, told reporters at a press conference on Friday.

He said the company has planned a HK$3 billion capital expenditure in 2011, in which HK$1.5 billion will be used for affordable housing projects.

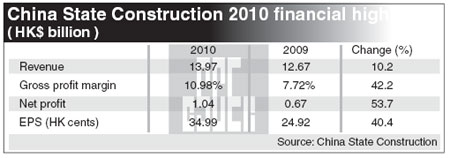

The construction firm earned HK$1.04 billion for the year ended December 31, up 53.7 percent from the HK$674.1 million net profit in 2009, according to a statement it filed to the city's bourse on Friday.

Revenue increased 23.5 percent to HK$12 billion in 2010 from HK$9.7 billion a year earlier, while its gross profit margin increased 3.26 percentage points to 10.98 percent from 7.72 percent in 2009.

Zhou said that unlike ordinary housing contract projects, where the gross profit margin stands at around only 5 to 8 percent, affordable housing projects will provide them with an up to 15 percent gross profit margin through build-operate-transfer protocols. This dictates that a company first build up and operate the low-cost homes in the first instance, after which local governments will gradually purchase them back through concession.

In February, CSCI sealed two affordable housing projects in Chongqing with a contract value of HK$2 billion, including a relocation housing project with a gross-floor-area of 375,000 square meters and a public rental housing project of 400,000 square meters.

Around HK$2 billion will be put into the two projects in Chongqing, according to Zhou. He added that the company is currently in contact with several local governments on the mainland regarding the affordable housing projects and he estimated the company will snatch five to six projects in the year, for a total of at least 300 million square meters of gross floor area.

"Engaging in the affordable housing business is definitely rewarding to CSCI as the central government is dedicated to building affordable homes," said Kenny Tang, an executive director at AMTD Financial Planning Ltd. "Compared with construction works, getting involved in public housing projects is essentially an investment which will yield much higher profits to the company."

China will spend about 1.3 trillion yuan to build 10 million units of government-subsidized housing this year, Qi Ji, vice-minister of housing and urban-rural development, told a news conference on March 9.

The nation will build 10 million units more subsidized housing next year and 16 million from 2013 to 2015, in order to cover 20 percent of the country's total housing supply when the program ends.

China Daily

(HK Edition 03/19/2011 page2)