Brake on new projects slows China Railway's Q1 contract growth

Updated: 2011-04-08 09:16

By Joy Li(HK Edition)

|

|||||||||

|

Li Changjin, chairman of China Railway, attends a news conference to announce the firm's annual results in Hong Kong Thursday. Jerome Favre / Bloomberg |

Inflation fears put a spike in some projects but company expects to bounce back later this year

China Railway Group, the country's biggest railway builder, said new contracts in the first quarter fell slightly compared with the same period last year as the central government has put off some infrastructure projects on fears of worsening inflation spurred by investment.

"Our first quarter new contracts shrank slightly year-on-year as inflationary pressure lingers on. However, the national budget of 700 billion yuan ($106.97 billion) infrastructure spending will not change. As we enter the second half of 2011, there will be a slew of new projects coming," Li Changjin, chairman and executive director at China Railway, told a press conference in Hong Kong on Thursday.

China's central bank raised the interest rate by 25 basis points on April 5, the fourth rate hike since last October. Qu Hongbin, co-head of Asian economic research at HSBC, commented that Beijing is clearly still "worrying about inflation, not growth" and the market should get ready for more hikes in the coming months.

China's CPI, a measure of inflation, rose 4.9 percent in February. The country has set an inflation target of 4 percent for 2011.

China Railway's shares closed at HK$4.54 ($0.58) per share, down 2.99 percent from Wednesday. The benchmark Hang Seng Index closed at 24281, down 0.01 percent.

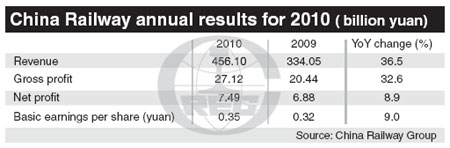

For full-year 2010, China Railway's net profit increased 8.9 percent to 7.49 billion yuan. Revenue increased 36.5 percent to 456.1 billion yuan. Infrastructure remained as the biggest revenue contributor, accounting for 86.3 percent and raking in 416.5 billion yuan. For its infrastructure construction business, the value of new contracts signed last year increased 14.3 percent to 619.48 billion yuan.

The company has a 40 percent share in the railway market and 50 percent in the urban rail market, according to its statement.

The gross profit margin at its infrastructure construction business dropped 0.5 percentage point to 4.5 percent in 2010.

Li Jiansheng, chief financial officer, explained that profitability was dragged down because some new projects cannot achieve gross profit and contracting costs were on the rise. She added that the pressure is limited in the short to medium term since the company signed a contract with the Railway Ministry, which means the contract price can be adjusted as costs rise.

Looking ahead, Chairman Li Changjin believes that railway construction in China will continue its strong momentum in 2011 and 2012 and then embark on steady growth.

"By the end of the 12th Five-Year Plan, we hope to diversify our business into four pillars, namely domestic infrastructure construction, overseas businesses, property and resources development," said Li.

China Railway now boasts 15 million square meters of land bank and expects its real estate business to be another growth driver. Revenue from property development was 11.71 billion yuan in 2010, up 114.63 percent from a year ago. Li said China Railway's property development strategy focuses on second-tier cities, which have not been directly affected by the government's tightening measures to cool the heating sector. He said the company will further invest in this unit, which is expected to bring in 30 to 40 billion yuan revenue by 2015.

In 2010, the company's overseas businesses, which are located in Southeast Asia, Eastern Europe and South America, recorded revenue of 22.86 billion yuan, up 140.43 percent year-on-year.

"Top Chinese companies see 'internationalization' as an important strategy amid the financial crisis," said Li, adding that China Railway will be proactive in its expansion and is aiming for 60 billion yuan in revenue from overseas markets by 2015.

China Daily

(HK Edition 04/08/2011 page2)