Stocks climb as China Unicom, HSBC advance

Updated: 2011-04-09 06:55

(HK Edition)

|

|||||||||

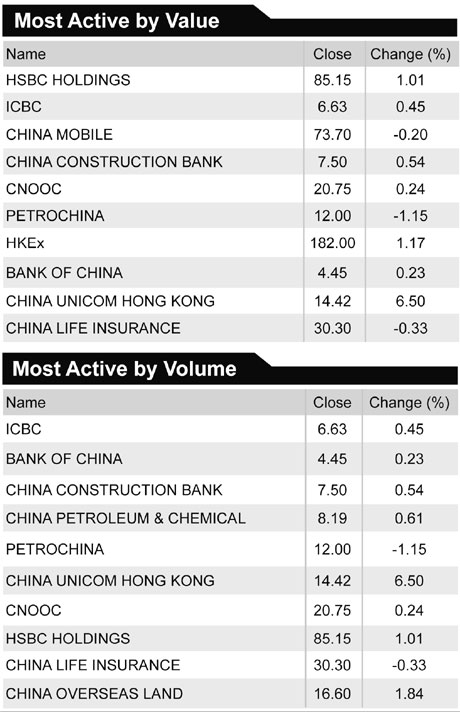

Hong Kong stocks rose Friday, sending the Hang Seng Index (HSI) to its third weekly gain, as China Unicom (Hong Kong) Ltd and HSBC Holdings Plc advanced after analysts forecast growth.

The HSI climbed 0.5 percent to 24396.07 at the close, gaining 2.5 percent for the four-day week that was shortened by a holiday. About three stocks rose for every two that fell on the 45-member HSI. The Hang Seng China Enterprises Index were little changed at 13652.92.

China Unicom jumped 6.5 percent to HK$14.42, the steepest gain in the HSI. UBS raised its 12-month share-price estimate by 47 percent to HK$20, citing the company's "explosive" growth in third-generation mobile-phone subscribers.

HSBC increased 1 percent to HK$85.15, the biggest contributor to the HSI's advance.

"We expect earnings recovery and improving revenue growth for HSBC ex-Asia in the next few years," Goldman Sachs, which has a "buy" rating on the stock, said in a report dated Friday. "We think it is worth buying HSBC for Asia earnings prospects alone."

Futures on the Standard & Poor's 500 Index added 0.3 percent Friday. The index rose as much as 0.2 percent Thursday as reports showed a drop in jobless claims and improving retail sales. The gauge closed 0.2 percent lower after another strong aftershock shook Japan and a dispute over the US federal budget threatened to shut down the American government.

Applications for jobless benefits fell 10,000 in the week ended April 2 to 382,000, the fewest since February 26, US Labor Department figures showed Thursday.

Li & Fung gained 2.3 percent to HK$40.50. Foxconn International Holdings Ltd, the world's largest contract maker of mobile phones, increased 0.9 percent to HK$4.72.

The HSI rose 5.4 percent this year through Thursday, compared with a 0.3 percent gain for the same period last year. Shares in the gauge traded at an average 12.8 times forecast earnings Thursday, compared with 14.4 times at the end of last year, according to data compiled by Bloomberg.

China Gas surged 5.7 percent to HK$3.74 after dealReporter said that PetroChina Co is considering making a bid for the company. PetroChina's spokesman Mao Zefeng said Friday it has no immediate plan to buy a listed gas company. PetroChina fell 1.2 percent to HK$12.

Futures on the HSI rose 0.5 percent to 24422. The HSI Volatility Index, the benchmark gauge for Hong Kong stock options, dropped 1 percent to 16.72, indicating options traders expect a swing of 4.8 percent in the HSI in the next 30 days.

Bloomberg

(HK Edition 04/09/2011 page3)