Residential site sold at upper end of estimates

Updated: 2011-04-28 06:44

By Li Tao(HK Edition)

|

|||||||||

|

The plot of land in Hung Hom was sold at auction for HK$1.52 billion to local developer Nan Fung Holdings on Wednesday, despite government efforts to curb property prices. Mike Clarke / AFP |

Hung Hom site sells for HK$1.525b

Hong Kong's first land sale of the fiscal year came in at the top end of estimates, defying the tough measures announced by the government last November to curb rising home prices.

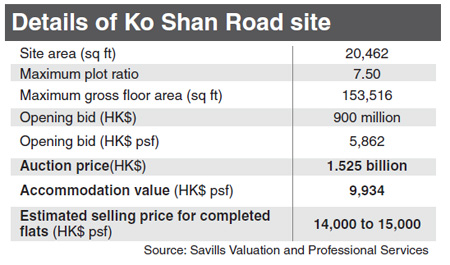

The Ko Shan Road site in the Hung Hom district, southern Kowloon, was sold to closely held local property firm Nan Fung Holdings for HK$1.525 billion ($196 million) on Wednesday. This was at the top end of estimates ranging between HK$1.07 billion and HK$1.53 billion, according to a poll of five surveyors and analysts surveyed by Bloomberg.

The final price was almost 70 percent higher than the opening bid of HK$900 million. It is equivalent to gross buildable area of HK$9,934 a square foot, according to real estate broker Centaline Property Agency Ltd.

Nan Fung will develop the site in a 50-50 joint venture with Wing Tai Properties Ltd, Donald Choi, managing director of Nan Fung, told the media after the auction.

Estimating that the selling price will exceed HK$15,000 per square foot, he added that the site will be built into more than 100 three to four-bedroom luxury apartments. It is estimated that it will cost HK$500 million to HK$600 million to build the project.

Choi said that a selling point of the site was its convenience. He said it was located in one of the city's urban heartlands and adjacent to a future MTR station.

Auctioneer G.M. Ross, deputy director of the Lands Department, said the result was "well within expectations but towards the upper end".

"The bidders are being positive in the way that they are bidding. They are not holding back," Ross told reporters after the auction. He added that the land sale shows that the city's developers have a strong interest in this type of property.

James Cheung King-tat, a director at Centaline Surveyors, said that the price of the land sale was a positive development. "This is reasonable and shows most developers believe the market has already digested the latest measures to curb prices and are confident prices will remain solid," Cheung said.

He said the completed properties on the plot should sell for at least HK$13,000 per square foot for the developers to see reasonable returns.

Charles Chan Chiu-kwok, managing director of Savills Valuation and Professional Services (Greater China), said he believes the higher-than-expected sales result reflects the positive views of developers towards the property market in Hong Kong.

"As land in urban areas is insufficient and the government does not have a long-term plan for urban land supply, together with pressure from heritage preservation groups, land in urban areas have become precious, leading to its surging price," said Chan.

On April 13, Financial Secretary John Tsang said the government will try to boost land supply in the city by selling 12 sites in the second quarter - nine for residential development - in a bid to curb soaring home prices in the city.

Hong Kong may auction as many as 52 plots of land this year, Tsang said in the government's budget speech on February 23.

China Daily

(HK Edition 04/28/2011 page2)