Door opens for dual-currency IPOs

Updated: 2011-06-23 07:23

By Oswald Chen(HK Edition)

|

|||||||||

|

The HKEx flag flies alongside the national flag outside the Hong Kong Stock Exchange. The bourse announced that it will launch a yuan liquidity pool as early as September to help support trade in yuan stocks. Mike Clarke / AFP |

Charles Li: We expect more yuan IPO applications in second half

Hong Kong Exchanges & Clearing Ltd (HKEx), the world's most valuable exchange operator, is proposing to let investors subscribe to yuan-denominated initial public offerings in the city by using the local currency.

It also expects more companies to apply for yuan IPOs in the second half of the year. Companies looking to list will also be given an option of a pure yuan share sale, or a dual-currency share sale in both the mainland currency and the Hong Kong dollar, HKEx Chief Executive Charles Li said on Wednesday.

"The proposal is meant to enhance the credibility of the yuan currency in the local yuan-denominated IPO process and to consolidate its position amid a backdrop of internationalization," Li said.

He added that HKEx was preparing for the day when the mainland's capital account opens and mainland investors are able to buy shares overseas and give investors the option of tapping into that market.

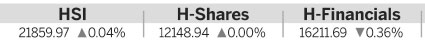

Yuan deposits in the city have expanded quickly since the announcement last July allowing for freer use of the currency offshore. HKEx also announced that it will launch a yuan liquidity pool as early as September called the trading support facility (TSF). The TSF will help support trade in yuan stocks, lending a hand to investors who have difficulty finding enough yuan access.

The liquidity pool is necessary not only because the mainland operates a closed capital account, it is also because investors only have access to 510 billion yuan currently sitting in bank deposits in Hong Kong. Theoretically these could be wiped out if a few large yuan-denominated IPOs were many times oversubscribed.

However, yuan deposits have been growing rapidly and HSBC expects deposits to almost double to 1 trillion yuan by the end of the year.

HKEx also revealed the dual-tranche option will only apply to larger IPOs and not smaller ones, which will by yuan-denominated only.

"By allowing switching between yuan-denominated shares and Hong Kong dollar-denominated shares, this proposal can enhance investors' choices, provide more market opportunities for arbitrage and reduce the "stress" on the yuan currency pool in the city for yuan-denominated IPOs," said Bryan Chan, head of the exchange's RMB Products Taskforce.

"We expect companies to apply for yuan-denominated initial public offerings in the second half of this year as the offshore renminbi market grows rapidly. However, at this point of time, we have not received any more yuan-denominated IPO applications," Li added.

Billionaire Li Ka-shing's Hui Xian Real Estate Investment Trust raised 10.5 billion yuan ($1.6 billion) in Hong Kong's first yuan-denominated IPO in April, paving the way for other products in the currency. The city is seeking to become the mainland's premier offshore currency center, with yuan debt sales doubling last year and the government looking to introduce other products.

HKEx is confident that the abundant liquidity pool in the city can facilitate yuan equity trading smoothly as local yuan deposits increased 13 percent from the previous month to 511 billion yuan in April, data from the Hong Kong Monetary Authority showed.

Bloomberg and Reuters contributed to this story.

China Daily

(HK Edition 06/23/2011 page2)