Oil supply boost won't affect local stocks: Analysts

Updated: 2011-06-25 07:18

By Oswald Chen(HK Edition)

|

|||||||||

|

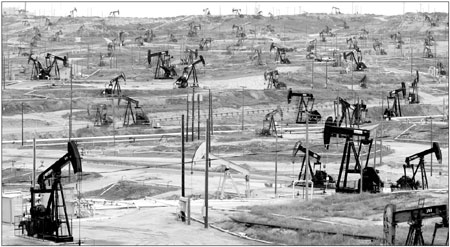

Oil pumps work in a field in the US state of California. The International Energy Agency announced on Thursday the release of 60 million barrels of oil in July. Ken James / Bloomberg |

Financial analysts said on Friday that the previous day's oil-price plunge after the International Energy Agency (IEA) announced it will release crude oil from its reserves in a bid to shore up the global economic recovery, should not have much of a long-term effect on Hong Kong-listed oil and aviation stocks.

The IEA announced on Thursday the release of 60 million barrels of oil in July. The use of emergency stockpiles to replenish oil supply due to the disruption of Libyan oil exports surprised markets and highlighted the deepening concern among the Organization for Economic Cooperation and Development nations over the damage of high energy costs to a worsening global economy.

The move marked only the third time that the IEA has used the release mechanism to pump up oil supply in the market. Unlike the previous two oil releases, which immediately followed the start of the Gulf War in 1991 and the Hurricane Katrina disaster in 2005; this one signaled that the IEA may be more concerned with tempering oil prices to aid a faltering economic recovery.

The news triggered a knee-jerk reaction in the local stock market, particularly in the oil and airline sectors.

Airlines received a big boost as investors bet that lower oil prices will help relieve the cost pressure on them. Shares of Hong Kong flag carrier Cathay Pacific jumped 5.3 percent on Friday. The three mainland-based airlines also surged. China Southern Air climbed up by 6.4 percent, China Eastern Air rose 6.6 percent, and Air China jumped 7.7 percent.

"In the short-term, oil prices falling alone is a positive factor for airlines," said Danny Yan, a fund manager at Haitong International Asset Management.

However, analysts are generally unconvinced that the IEA's move will have a significant impact on the supply-demand fundamentals.

"We would expect the release to have less of an impact on prices further out the curve, as the oil would be absorbed to meet current demand," Goldman's energy team, led by David Greely in New York, said in a note to clients.

"Though the news will exert short term psychological negative impacts on oil prices, we expect the New York crude oil price to secure a solid footing at around $90 per barrel because the current level of global economic activities should provide demand that can sustain the oil price at this level," Dickie Wong, research manager at Kingston Securities, said.

With the tight supply situation likely to remain in the oil market, analysts believe the fluctuation in share prices of oil firms and airlines will be short-lived in nature.

"Sixty million barrels may not be able to change the global oil supply-and-demand landscape dramatically," said Kelvin Lau, a Hong Kong-based Daiwa Securities Group analyst.

"The drop in oil prices is positive for carriers, but the momentum will be short term," he suggested.

Kingston's Wong is of the same view. "For air carrier stocks, though the news could give an immediate boost to the share price, the share price performance in the long run still depends on the profitability of these carriers."

Local-listed oil stocks were mixed in Friday's trading. PetroChina and Sinopec, whose crude refining business could benefit from lower crude prices, rose 2 percent and 3 percent, respectively. Shares of pure oil producer CNOOC Ltd and energy trader Glencore dipped 1.2 percent and 2.3 percent, respectively.

New York crude oil and Brent oil tumbled over 4 percent to a four-month low to $91.02 per barrel and $108.60 per barrel respectively in Thursday on the IEA news.

Share prices of locally-listed oil stocks are expected to remain stable as the New York oil price stays above $90 per barrel, Kingston's Wong said.

Reuters and Bloomberg contributed to the story.

China Daily

(HK Edition 06/25/2011 page2)