BYD increases sharply on Berkshire comment

Updated: 2011-07-05 07:39

(HK Edition)

|

|||||||||

BYD Co surged the most in more than nine months in Hong Kong trading on Monday after Berkshire Hathaway Inc Vice Chairman Charles Munger said the Chinese automaker has the ability to recover from missteps.

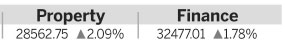

BYD jumped 10 percent to HK$27.70 for the biggest gain since September 17, while its Shenzhen-traded shares surged by the 10 percent limit for a second day. Warren Buffett's Berkshire bought a 9.9 percent stake in the automaker in September 2008.

Munger said on July 2 that executives at BYD "just put their head down and try harder" when they fail. The carmaker has lost about two-thirds of its market value since reaching a record in October 2009. Vehicle sales declined for 10 straight months through May and the company reported an 84 percent plunge in first-quarter profit.

"Investors have been concerned about whether Buffett will sell its holdings in BYD," said Harry Chen, an analyst with Guotai Junan Securities Co in Shenzhen. "Munger's comments about BYD are seen as a vote of confidence and helped push up its shares."

BYD's auto sales have been pressured as China removed incentives that spurred buying for cars with engines smaller than 1.6 liters, such as the Shenzhen-based company's F3 sedan. Passenger-car sales on the mainland fell 0.1 percent in May from a year earlier, the first decline in more than two years, according to the China Association of Automobile Manufacturers.

Other Chinese automakers surged on Monday after China Business News reported regulators are talking about loosening policies for the industry and Xinhua News Agency said auto sales may recover in the second half, citing Dong Yang, deputy head of the manufacturers group.

Dongfeng Motor Group Co rose 6.9 percent in Hong Kong. Guangzhou Automobile Group Co climbed 5.2 percent, while SAIC Motor Corp, China's largest carmaker, advanced 3.1 percent in Shanghai trading.

Bloomberg

(HK Edition 07/05/2011 page2)