ADB marks down Asian growth forecast to 7.5%

Updated: 2011-09-15 07:12

By Joy Li(HK Edition)

|

|||||||||

Global economic woes to temper outlook this year and next

Developing Asia's growth momentum, led by East Asia in particular, will be tempered for the rest of this year and next, as global economic woes damp external demand, the Asia Development Bank (ADB) said.

In its Asian Development Outlook Update 2011 released on Wednesday, ADB revised down its full year forecast to 7.5 percent from 7.8 percent in April. It also lowered its 2012 projection to 7.5 percent from the previous 7.7 percent. Developing Asia is made up of 45 member countries, according to Manila-based ADB.

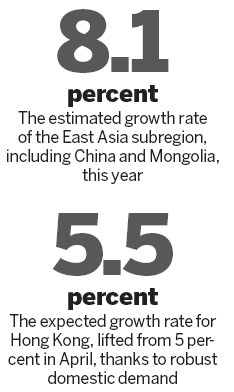

East Asia, which includes the mainland, South Korea, Hong Kong, Taiwan and Mongolia markets, will be the fastest-growing subregion, expected to grow at 8.1 percent in 2011, said ADB.

The forecast was trimmed from April's 8.4 percent, mainly due to a reduction in its projection for the mainland, the largest economy in the subregion. It has been cut to 9.3 percent from 9.6 percent, as a result of monetary tightening to tame inflation and sluggish external demand, according to the ADB report.

However, the forecast for Hong Kong this year has been raised to 5.5 percent from 5 percent in April, thanks to robust domestic demand lending support to the city's growth in the first half, said ADB.

ADB Chief Economist Changyong Rhee, said that the forecasts did not assume a "doomsday" arising from a slugglish US economy and a worsening European sovereign debt crisis.

"If it does happen this time, I don't think there's room for the U.S. and Europe to bail out their banks again" Rhee said at a press conference in Hong Kong, adding that "if this happens there would be huge turmoil in the global financial market."

Hong Kong's Hang Seng Index at one point dipped to its lowest reading since July 2009 during Wednesday trading after Premier Wen Jiabao said at the 2011 Summer Davos Forum that China should not be expected to bail out the world economy and developed countries should "put their own houses in order." The benchmark index has tumbled 17 percent this year, mainly rattled by the dim outlook for the US economy and worsening debt problems in Europe.

Liz Ann Sonders, chief investment strategist at Charles Schwab & Co, an asset management firm, thinks that declining confidence and continued erosion in the markets have a self-fulfilling aspect to them, which is one reason why the possibility of a recession has grown.

Frederic Neumann, economist at HSBC, wrote in an August 26 report entitled "Can Asia Save the World?", that although increasing domestic demand can serve as a buffer for Asia if things turn messy on the other side of the world, it doesn't mean that it has the muscle to pull everyone else along.

Strong domestic consumption and expanding intraregional trade should help underpin growth amid global uncertainty, with the share of intraregional exports among the largest economies in the region rising from 42 percent in 2007 to 47 percent in the first half of 2011, according to ADB.

joyli@chinadailyhk.com

China Daily

(HK Edition 09/15/2011 page2)