No plan to ban short selling

Updated: 2011-10-07 06:50

By Fox Huand Lynn Thomasson(HK Edition)

|

|||||||||

|

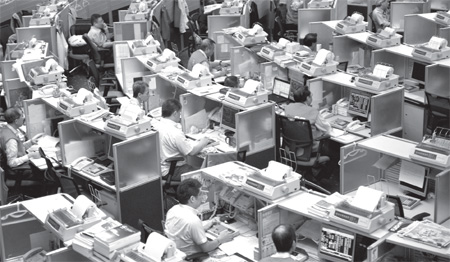

Traders work the floor at the Hong Kong Stock Exchange on Thursday. Hong Kong shares soared 5.67 percent following a strong performance on Wall Street and on hopes European leaders will agree a plan to resolve the eurozone debt crisis. Laurent Fievet / AFP |

Hong Kong doesn't plan to ban short selling of securities, rejecting a request from some brokerages after the city's benchmark index tumbled 26 percent this year.

"When markets fall, it's not like we can stop it by just banning short selling," K.C. Chan, Hong Kong's secretary for financial services and treasury, told reporters on Thursday. "Shorting activities are so far relatively normal and we're keeping a close watch."

Seven brokerage groups said Hong Kong, the world's fifth-largest equity market, should consider a ban on short selling, according to Christopher Cheung, honorary chairman of the Hong Kong Securities Professionals Association.

"The government should disclose more information of short-sellers," said Cheung, also the chairman of Christfund Securities Ltd. "Short selling recently has disturbed market operations and extraordinary measures are needed to boost investors' confidence."

Short selling climbed to the highest level in 12 years, with bets on declines reaching HK$12.8 billion ($1.6 billion) on September 30, or 14 percent of the total market turnover, according to data compiled by the city's exchange and Societe Generale.

"We are an international financial center, and one of the characteristics is a liberal trading system," Ben Kwong, chief operating officer at KGI Asia Ltd. "Funds flow in and out easily, and we have a liquid market. There is a cost we have to bear. That means volatility in the market."

Regulators from South Korea to Europe have restricted bearish bets this year to stem market volatility.

The Hong Kong Stock Exchange suspended short selling in HSBC Holdings Plc, Hong Kong Telecommunications Ltd and China Telecom (Hong Kong) Ltd on September 2, 1998, after Hong Kong Clearing Co reported millions of shares failed to be settled.

Bloomberg

(HK Edition 10/07/2011 page2)