Sun setting on the shipping industry

Updated: 2013-06-28 08:01

By Wong Joon San(HK Edition)

|

|||||||||

The recent dock workers' strike has again brought into sharp focus the already well-documented erosion of the port's competitiveness as a leading, global container facility. Wong Joon San reports.

The dock workers' strike that slowed but did not halt shipping activities at Hong Kong port dragged on for 40 days - longer than any industrial action in recent memory. Shippers and port management watched the gloomy unfoldment of the industrial action, as with each passing day the credibility of the port was eroded, lending additional credence to the contention that Hong Kong's container port is a sunset industry.

The strike was called March 28 by the Union of Hong Kong Dockers (UHKD), an affiliate of the Hong Kong Confederation of Trade Unions (HKCTU). The workers demanded that the contractors who employ them increase their wages, which workers contended had shrunk 20 percent. Up until the day of the strike, they had been getting paid HK$55.00 an hour. Back in 1995, they were paid HK$60.70 ($7.8) an hour.

The container terminal operator Hong4kong International Terminals Ltd (HIT)tried to distance itself from the dispute saying the problem belonged to contractors. Some years ago, however HIT decided to outsource its stevedoring jobs, crane operators' jobs and truck drivers' jobs to private contractors who had cut workers' pay. The beneficiary was a unit of Hutchison Port Holdings Trust (HPHT), which in turn is owned by Hutchison Whampoa Ltd (HWL), the flagship company of Hong Kong's wealthiest man, Li Ka-shing.

Berth 6 strike

The strike, with hundreds of dockworkers on the picket lines started at HIT's Berth 6, about a half hour's drive from HWL'S headquarters at Cheung Kong Center in Central. Negotiations failed. HIT continued to keep its distance. Striking workers pressed HIT and Li to step in, improve pay, improve working conditions and get the thing settled. Nothing happened. The dockworkers escalated their action and set up a picket line outside Cheung Kong Center. The strike ballooned into a weekend protest asking Li to intervene. According to police estimates 2,800 people joined. Cheung Kong Center management was forced to obtain a court injunction ordering the strikers out of the company's public areas. The strike and protests continued until May 6, when workers accepted a 9.8 percent pay raise.

An estimated 450 dockworkers managed by contractors - Everbest Port Services, PuiKee Stevedore Company, Lem Wing Transportation and Comcheung Human Resources took part in the strike.

HIT said the strike cost the company HK$5 million a day, HK$200 million over the 40-day duration.

According to Labour Secretary Matthew Cheung Kin-chung in a written reply to a question from LegCo, dock workers lost an aggregate sum estimated at more than HK$10 million in wages.

The strike is over. But the ripples continue spreading.

At the height of the dispute, shippers sent their cargoes through south China ports. Shipping lines like APL, MOL and Wan Hai, switched to ports at Chiwan and Shekou.

The shippers and shipping lines liked the lower costs on the mainland. Some shipping companies reportedly are switching more services across the border. Unconfirmed reports says that APL and CMA CGM have switched between 10 to 20 percent of their Hong Kong calls to Chiwan, while MSC has switched a few of its Hong Kong calls to a mainland port.

Shippers are worried about more strikes in Hong Kong down the road, potentially at peak seasons, in summer. Anything like that would severely harm business relationships with customers overseas, and expose local companies to heavy penalties if they failed to meet their shipping commitments.

Labor peace vital

Sunny Ho, executive director of the Hong Kong Shippers' Council, agrees that the effect of the dock workers action could strike at the very heart of Hong Kong's competitive position as a major port over the long term.

"It really depends on whether the city's container terminal operators can maintain a harmonious relationship with their workers, who are members of 16 unions at Kwai Tsing container terminals," he contends.

Another after-effect was truckers discharging their empty containers around Shenzhen, instead of bringing them back to Hong Kong for storage, as they had done in the past, Ho explains.

That situation alone reduced the volume of container throughput via Hong Kong and at the same time, affected the income of people who lease land for container storage in Hong Kong.

Halting erosion

Alan Lee, chairman of Hong Kong Container Terminals Operators Association (HKCTOA), argues that Hong Kong still holds its competitive edge over Shenzhen. He cites Hong Kong's efficiency, reliability, high frequency of shipping lines giving shippers more destinations than neighboring ports. Hong Kong also has excellent logistics and support services. On the other hand he says the city still has to deal with several issues which are eroding that competitive edge.

Lee explains that faced with shortage of backup land for storing containers, container terminal operators must bid for scarce land put out for tender by the government. The problem is exacerbated by competing bids from trucking companies, seeking land for parking tractors and trailers.

More containers are being transported from South China to Hong Kong by barge. It's a cheaper alternative to trucking and Lee says the government should seriously consider a program to address the short supply of berths for shipping barges, if possible, at the public cargo working area next to Terminal 8.

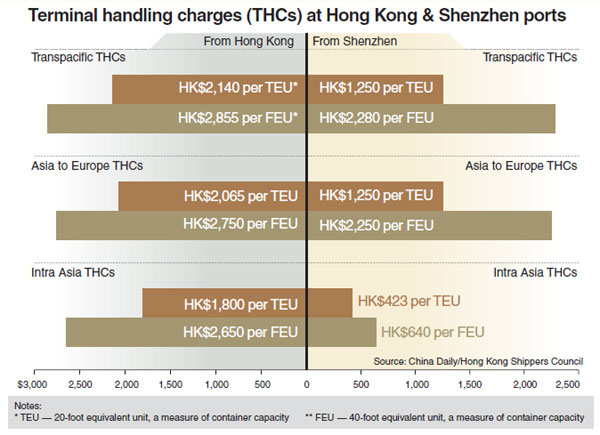

Shipping lines should try to reduce the terminal handling charges (THCs) they charge shippers in Hong Kong. THCs have remained steadily high for many years - and he contends, simply too high when compared to charges at Shenzhen ports. Lee points out that many people confuse the shipping lines' THCs with the container handling charge (CHCs). CHCs, imposed by container terminal operators on shipping lines for handling containers at their facilities, have been falling over the years because of heavy competition.

Lee elaborates, it is more expensive for a truck to transport a container across the border from Dongguan to Hong Kong - than to Yantian International Container Terminals, in the eastern part of Shenzhen.

Hong Kong cross-boundary trucks are limited to around 1.2 trips per day under the current "stay-with" operating model of cross-boundary trucks, (the driver, truck, trailer and empty container are required to stay together for the duration of the journey).

"Though major efforts have been made to reduce queuing time for trucks at check-points, the situation has improved but the system is still inefficient," Lee says.

He also points out that the current labor shortage is another major sore point in the shipping industry, particularly with regard to crane operators, stevedoring and tractor drivers. Most young people do not want the jobs, with the problem seemingly becoming worse each day.

Contact the writer at joonsan@chinadailyhk.com

(HK Edition 06/28/2013 page3)